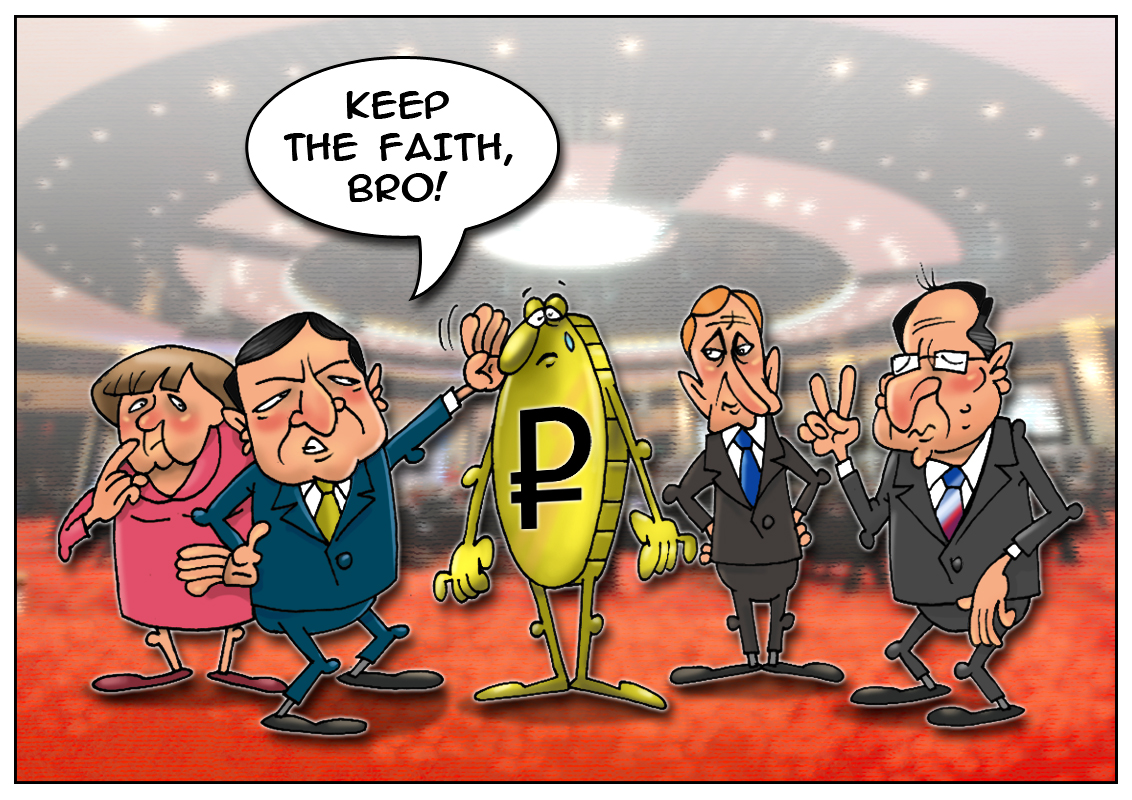

The catastrophic plunge of the ruble suspended for a while as a response to the results of the Ukraine crisis talks in Milan. The talks of the so-called Normandy Four (France, Germany, Russia, and Ukraine) resulted in a slight reinforcement of the ruble. However, in the light of its recent negative dynamic, this fact was presented to Russia’s population as the super effort of the Kremlin. Let’s consider the impartial statistics. At the time when the talks started, the dollar-euro basket value fell 40 kopecks down the floating corridor. After the talks ended and the political leaders made their statements, the U.S. dollar was trading at 40.78 rubles having dropped 9 kopecks from the previous closing price. As for the single European currency, it was trading at 52.17 rubles having lost 7 kopecks. The dual currency basket value equaled 45.9 rubles which was 8 kopecks lower than the previous closing price. Speaking at a press conference, Russia’s President Vladimir Putin noted the favorable impact of the talks on the general situation and viewed its outcome as “satisfactory”. The energy market absorbed the accord reached during the anti-crisis talks quietly. WTI at a session in New York halted at $84.79 per barrel, though Texas light sweet had sunk below $80 at the previous session. Meanwhile, Russia’s central bank shifted the dollar-euro corridor 30 kopecks upwards. Thus, the dual currency basket value was lifted 1.85 rubles in early October.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română