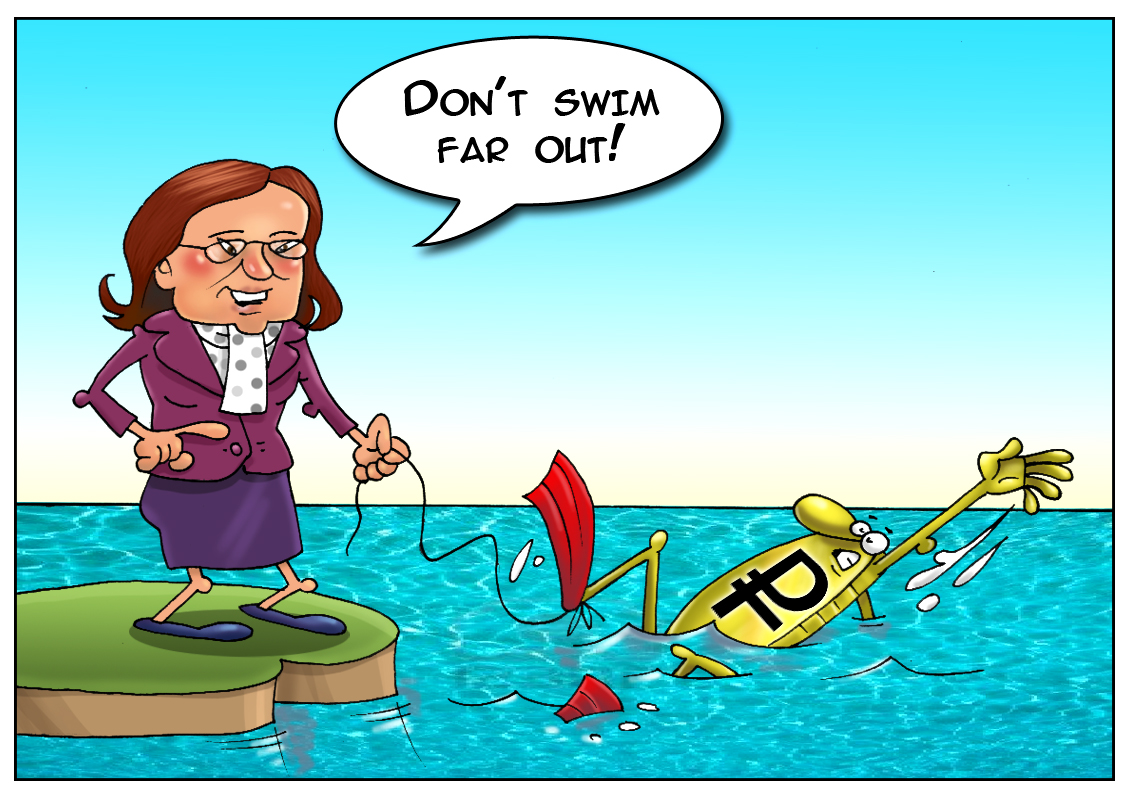

The Bank of Russia canceled the corridor of the currency basket and announced the end of financial interventions to support the national currency rate some time ago. In fact, the ruble was let float freely; however, the Bank of Russia reserved the right to carry out prompt interventions if financial stability is threatened. The message on the CB's website reads that “as a result of the implementation of this decision, the ruble exchange rate will be determined by the market factors that should enhance the efficiency of the Bank of Russia monetary policy and ensure price stability.” On the one hand, the ruble is let get out on its own, but on the other hand the bank is going to support it if needed. However, such a broad statement of the officials did not make a stir among the currency market participants. The government expected that the coming tax levy will be an additional support to the ruble exchange rate – let us recall that large exporting companies will start selling the currency to pay the charges to the budget. So if there are no grave political changes and new economic sanctions, it is possible that the ruble will stop its fall. The president of Russia Vladimir Putin highlighted the importance of the ruble's stability. “Our financial authorities are taking necessary measures. The Central Bank of Russia continues a policy of inflation targeting. We witness speculative ruble exchange rate surges today, but I believe that this will stop soon, I also refer to those steps which the Central Bank of Russia is taking in response to action taken by speculators,” Putin said at the APEC summit.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română