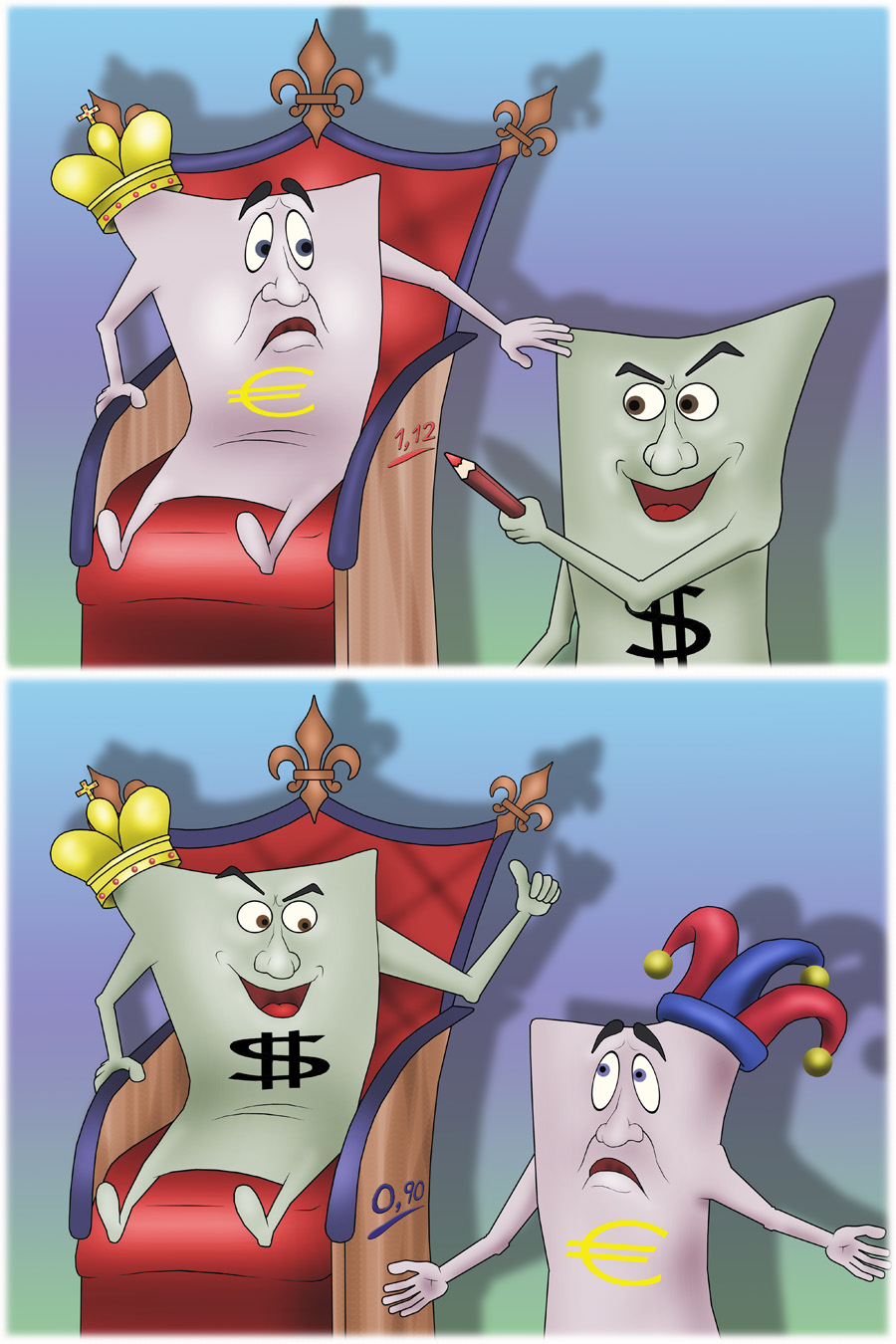

According to data from the Moscow Exchange, the euro dropped even lower than the nine-year minimum to $1.15 at the latest trading sessions.

The European currency weakens due to the start of Quantitative Easing that was announced by Head of the European Central Bank Mario Draghi on January 22. The program will be carried out until the end of 2016. During QE the ECB will purchase bonds of the EU member states. The ECB aims to allocate €1.2 trillion in total for the bond-buying program.

On January 12, American banking firm Goldman Sachs released economic development forecasts for different world’s regions. The forecasts were mainly about oil prices and currency exchange rates. Analysts at the bank anticipate that at the beginning of 2017 the euro will cost $1. By the year 2018, the euro is expected to trade at 90 U.S. cents.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română