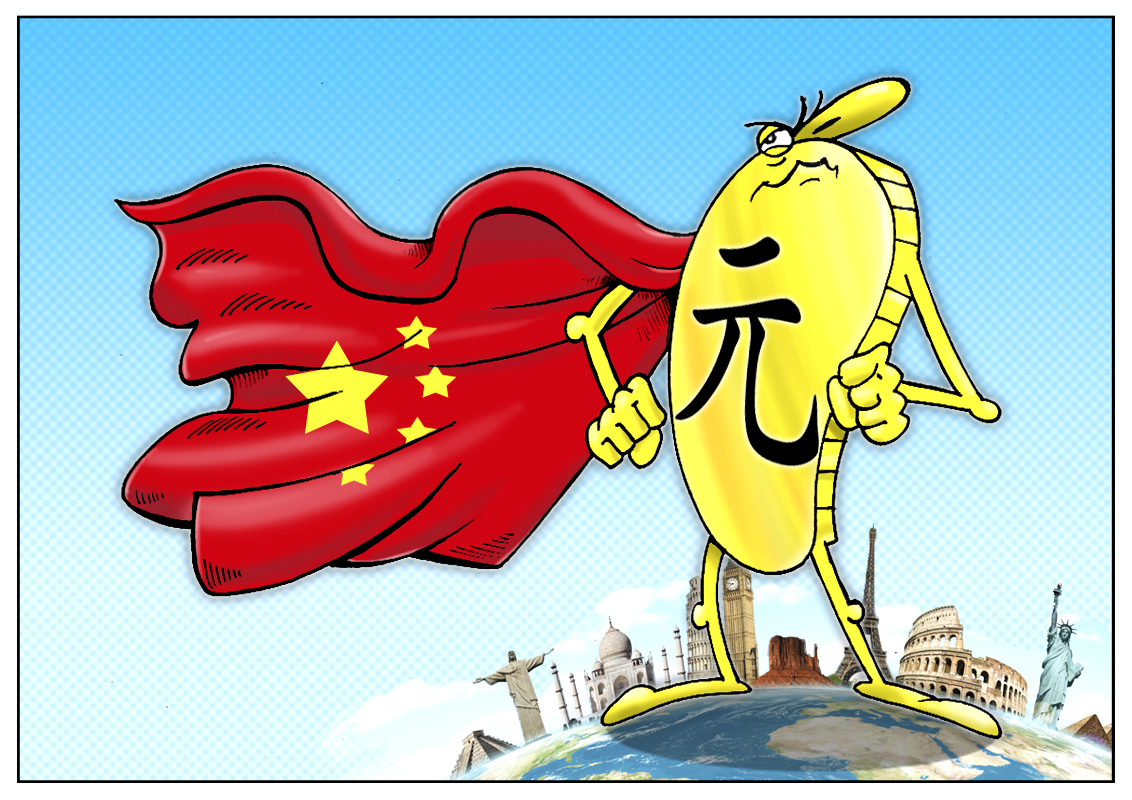

China’s aspirations for wider use of its currency are gaining ground, thus promoting the yuan as a global reserve currency alongside the dollar, the euro, and the yen. The Chinese currency, also called the renminbi, was used for 9.95 trillion yuan ($1.6 trillion) of international payments in 2014, according to a statement posted online by China’s central bank. There are now 14 offshore clearing centers for the yuan, while 28 central banks have swap agreements with China. So, Beijing is pursuing the policy to promote the yuan step by step as an international currency. In 2013, the yuan accounted for nearly a quarter of all transactions across China’s borders. Importantly, China’s economy was facing a challenge in 2014. GDP decreased the pace of its growth to the lowest level for 24 years. Thus, the economy expanded just 7.4%. However, such slowdown came as no surprise to foreign observers opposed to Chinese policymakers. In recent years, fast pace of economic growth rested mainly on credit expansion. The money supply has surged sevenfold since 2002 which certainly left its after-effects. As a result, the housing market created a bubble which was accompanied by a sharp rise of bad loans on banks accounts. Nowadays, Chinese officials are making efforts to get rid of the negative aftermath of the housing bubble. However, China’s economy can boast about achievements. In 2014, the industrial production was getting into gear. So, the industrial output rose in December to 7.9% annually from 7.2% in November, National Bureau of Statistics China reports.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română