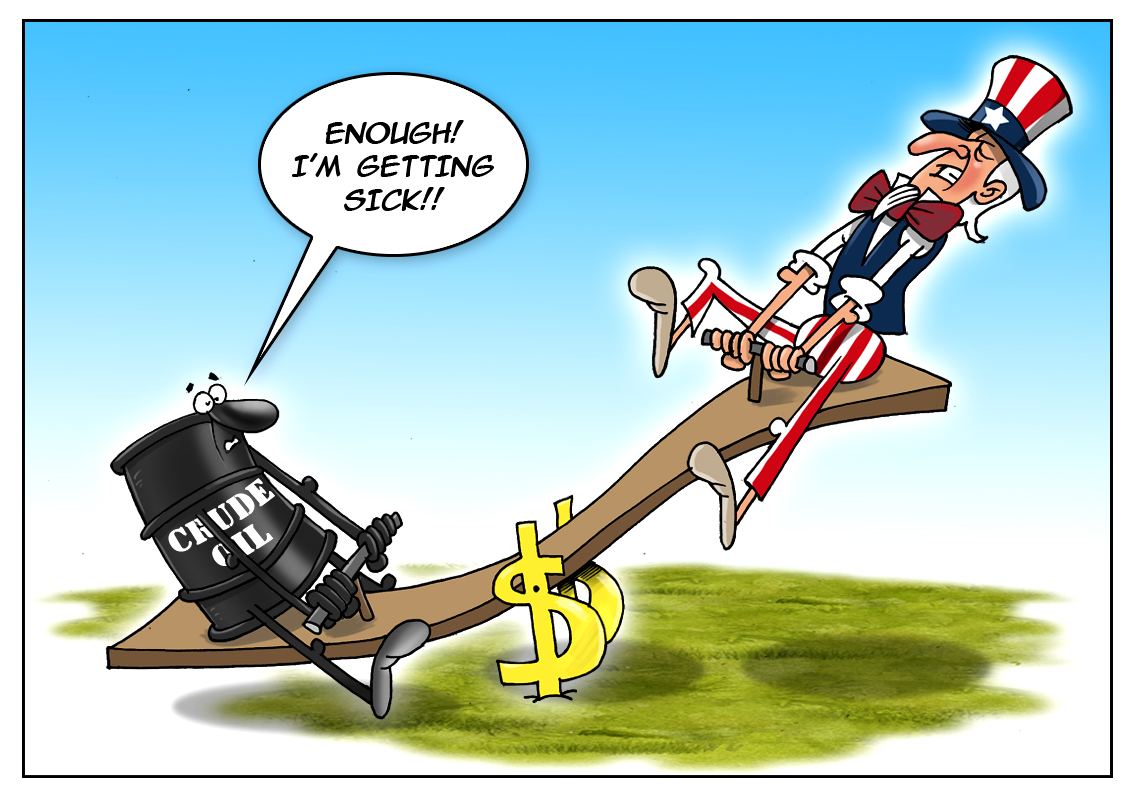

The US authorities still have strong influence on the global oil market. The world’s largest power easily manipulates oil prices. A minor increase in the US commercial crude inventories led to a drop in oil prices just after the information was revealed. As a result, the oil price lost 1.8%. However, a marginal rise in the US crude inventories is a real surge on a global scale. According to the data from the US Energy Information Administration (EIA), the country's oil inventories rose by 0.1% to 465.8 million barrels. The market’s reaction to the news was immediate. After the report publication, a rapid decline was logged in oil prices. Moreover, the decrease was accelerated by the news about an increase in the US rigs number. Thus, on the Intercontinental Exchange (ICE), Brent crude dropped by 1.63% to 56.88 US dollars a barrel. On the New York Mercantile Exchange, WTI crude futures for August delivery fell by 2.12% to 51.21 US dollars a barrel.

Iran and the group of six western powers adopted a final agreement that will allow Iran to come out of the isolation of the last decades. All sanctions will be lifted in return for Iran agreeing long-term curbs on a nuclear program. In this situation, the US decision is the key one.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română