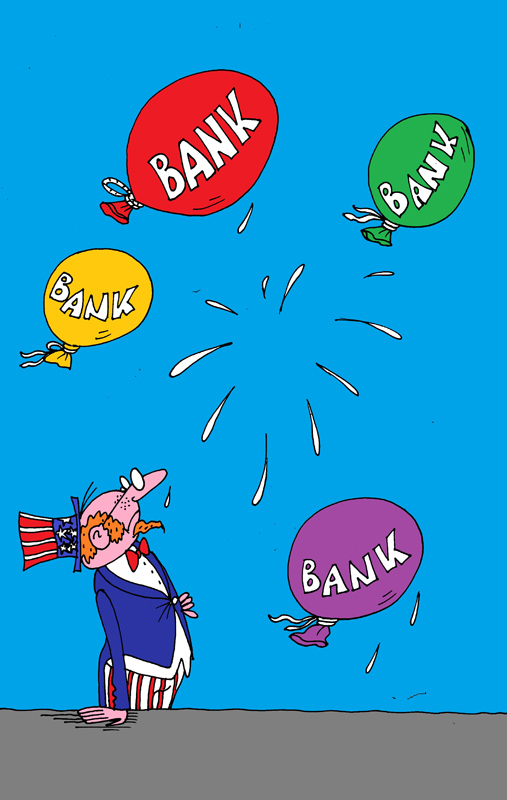

The Wall Street Journal reports that national tally of bank failures totalled 14 banks in the USA in 2013. On May 31, the Federal Deposit Insurance Corp. (FDIC) said it has seized Banks of Wisconsin located in Wisconsin. The reasons for the bank's failure are not disclosed.

According to the FDIC estimates, the Banks of Wisconsin will have to repay $26 million in deposit insurance. FIDC secures to give back deposits not exceeding $250K. The organization's assets totalled $134 million. The local North Shore Bank is said to purchase Banks of Wisconsin assets. The Banks of Wisconsin's branches will be named the North Shore Bank. Thus, the depositors of the Banks of Wisconsin will automatically become the depositors of the North Shore Bank. Complied with the FDIC data, 51 financial organizations ceased to exist in the USA in 2012, in 2011 the number jumped to 92, in 2010 – to 157.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română