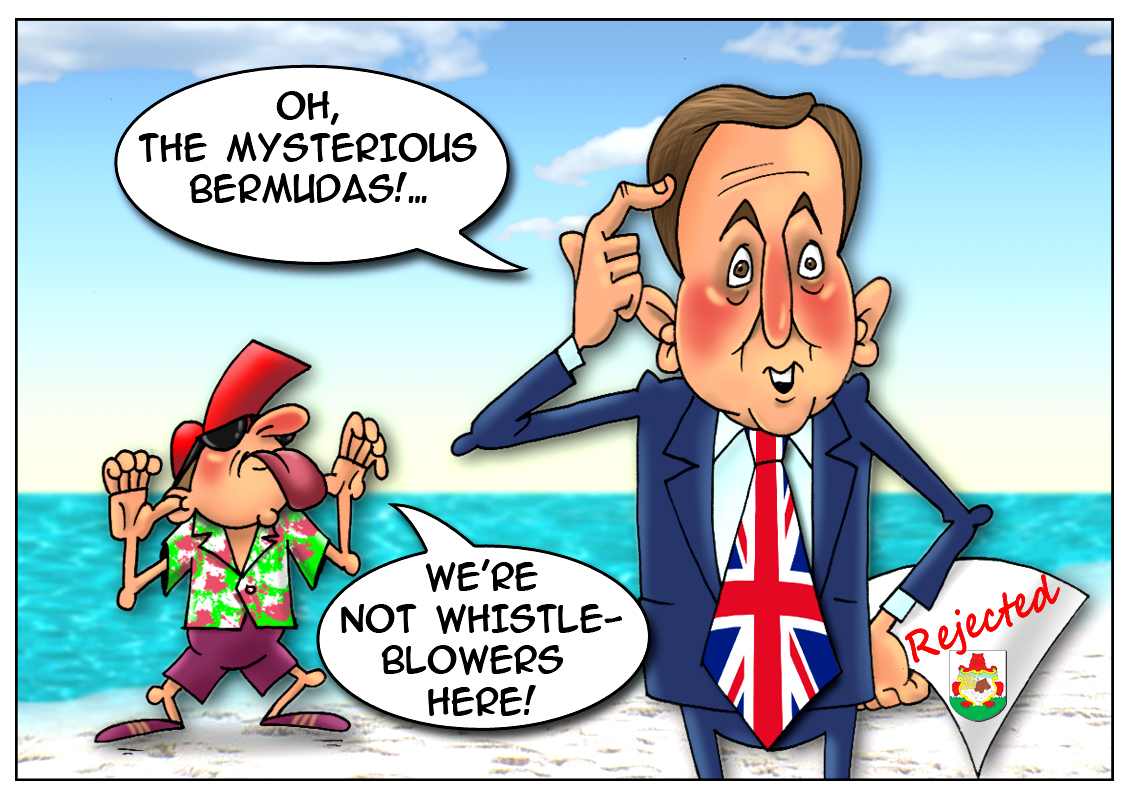

Bermuda has denied the proposal of UK Prime Minister David Cameron to sign a multilateral convention on mutual tax assistance. The fact is that some overseas territories agreed to provide personal data on offshore accounts and their owners, but the United Kingdom cannot get enough. So now the government has claimed for more detailed information. Although the convention has been already signed by more than 80 countries, Bermuda's authorities have no doubt that some points of the agreement may have a negative impact on the economic system and state revenue. “Bermuda's rejection of this international tax treaty shows that Cameron's tough talk of taking on tax havens is just that – talk. If Cameron was actually serious about tackling tax havens, he could simply legislate to abolish all the UK's tax havens, including Bermuda,” Murray Worthy, a tax campaigner at the British anti-poverty charity War on Want said. This refuse jeopardized the system for total control of money flows and this issue discussion at the G8 summit in Northern Ireland. Annually the tax evasion causes the European Union a loss of €1 trillion. To date, the Islands of Bermuda are almost the last haven of freedom without even a corporate tax. The analysts are of the opinion that if the country enters into the agreement, the bulk of funds will be withdrawn into Asian offshore accounts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română