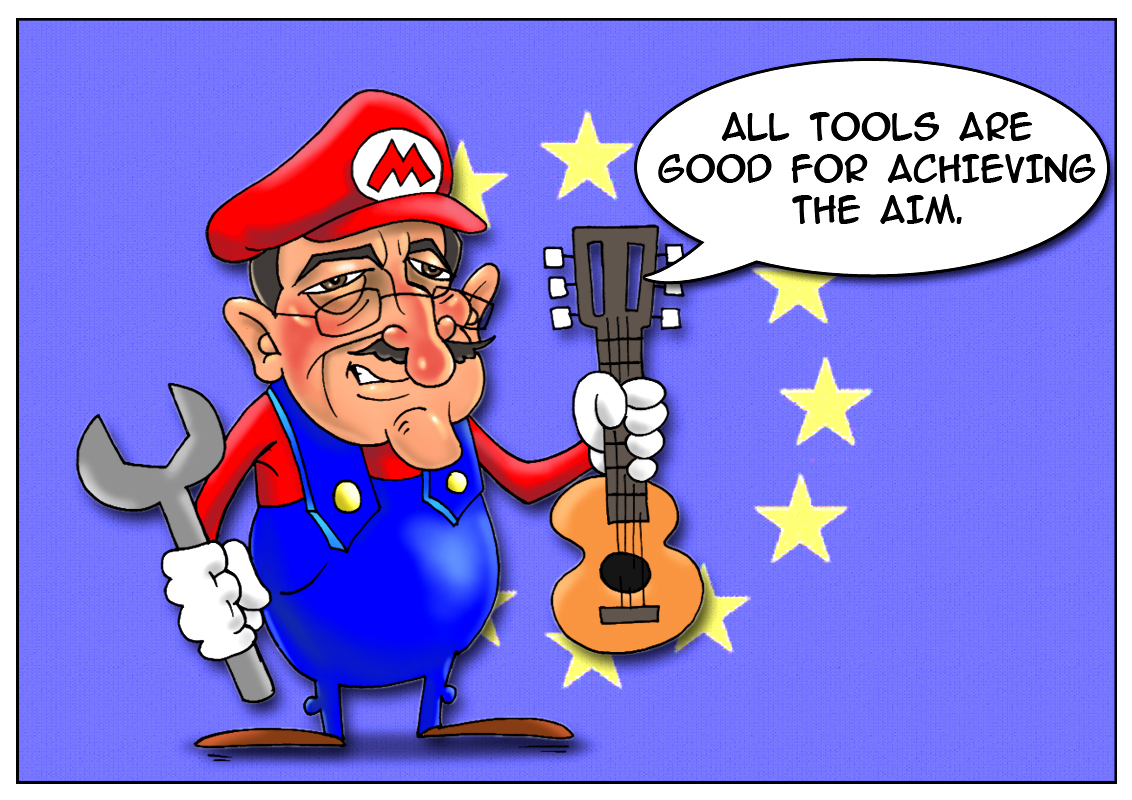

The European Central Bank Board and its President Mario Draghi are prepared to use other monetary policy tools as well as unconventional ones. “There are numerous other measures – standard interest rate policy and non-standard measures – that we can deploy and that we will deploy if circumstances warrant,” Draghi said at the meeting in Jerusalem. The main criteria in this case will be the tools efficiency, benefits and capability to maintain the economic stability in the region. “We will look with an open mind at these measures that are especially effective in our institutional setup and that fall within our mandate. Some of those measures may have unintended consequences. This does not mean that they should not be used, but it does mean that we need to be aware of those consequences and manage them appropriately,” he added. That was not the first time, when Mr Draghi proposes the implementation of unusual measures. He has already held out the possibility of using the negative deposit rate. Although it is hard to predict its possible consequences, such tools introduction is what the modern world needs. Mario Draghi is hoping that the novelties will boost the European domestic demand and help to deal with the crisis aftermath.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română