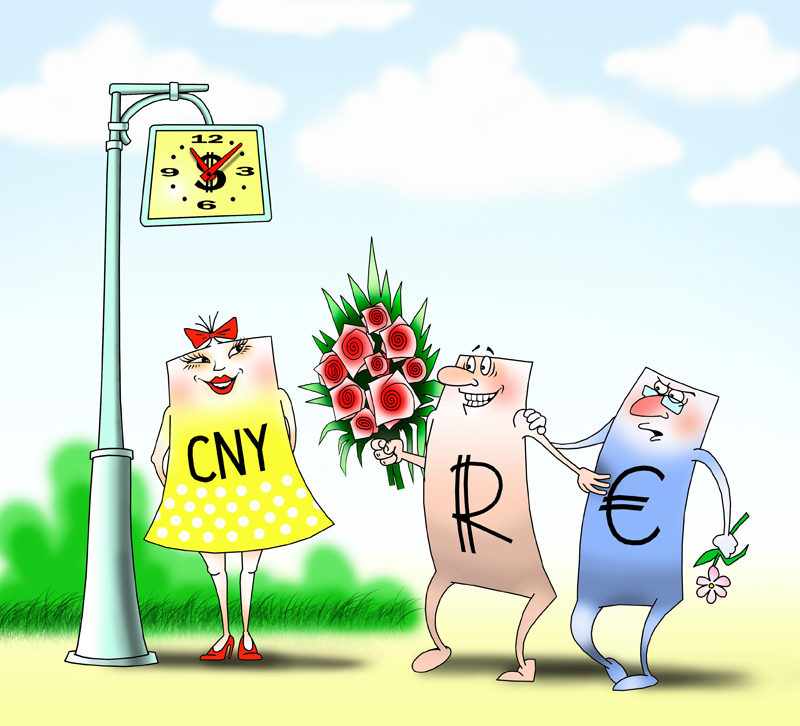

The number of world banks offering transactions in renminbi has sharply risen from 900 (as for 2011) to over 10,000 by July, 2013. This was announced by Germany’s Bundesbank Executive Board member Joachim Nagel at the conference in Frankfurt am Main that was devoted to the internationalization of the renminbi and its opportunities. The full text of his speech is available on the Bundesbank website.

According to Nagel, the percentage of trading transactions settled in renminbi has jumped from virtually zero to around 12% between 2010 and 2012. At the same time, international use of renminbi (approximately 0.69% of all transactions) does not reflect China’s economic prowess at present.

Joachim Nagel also stressed that Chinese yuan has the potential to become one of the future global reserve currencies. The China’s government has been actively promoting the international use of its currency since 2009 and now it resulted in a steadily growing demand for the renminbi. Thus, a survey among reserve managers revealed that 37% of them were considering investing in the currency in the next 5 to 10 years. Meanwhile, 14% of the respondents indicated that they have already invested in the renminbi.

Chinese government has never denied that its policy is aimed to increase the renminbi’s global role. However, in early 2013, China’s central bank said that it revised the U.S. economic power, predicting the dollar to remain the world’s paramount reserve currency for a decade to come.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română