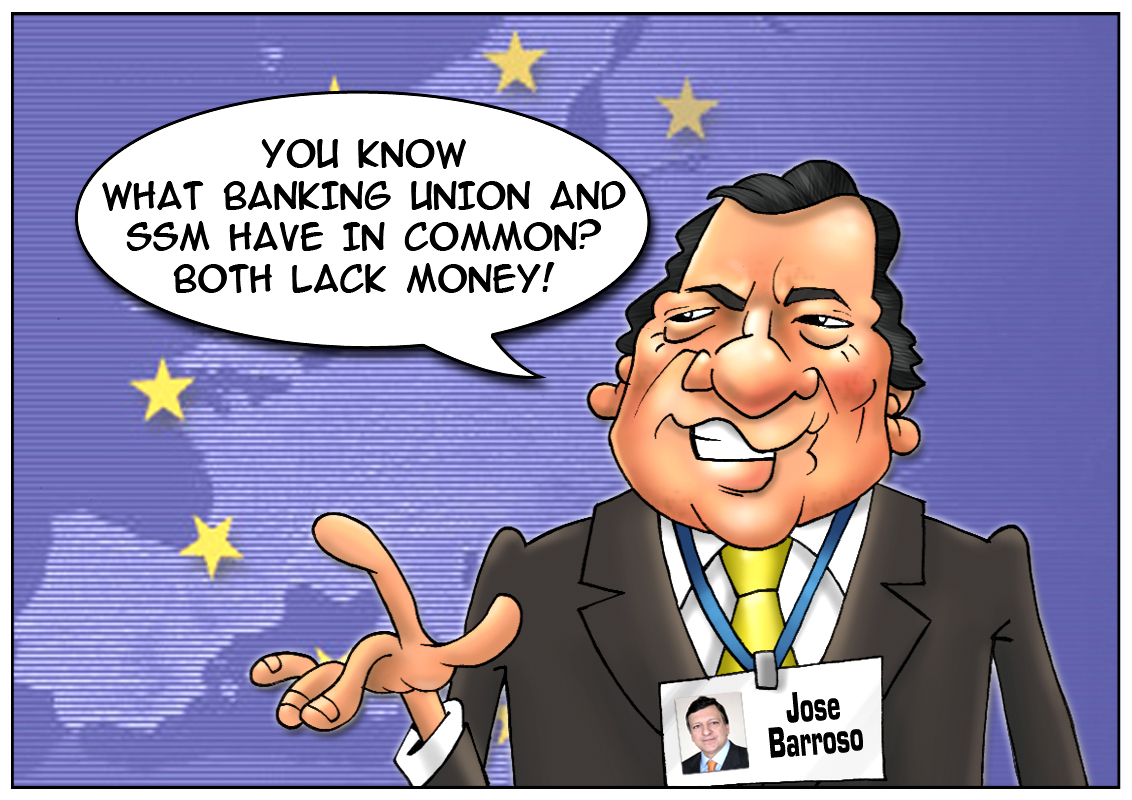

The European Union is planning to complete the development of the Single Supervisory Mechanism within the project of the Banking Union in late 2014. This new regulating body is supposed to liquidate or resuscitate the financial institutions suffering problems. The procedure of the SSM creation consists of several stages. First of all, the European Central Bank will take charge of the banks of those EU countries which decided to join the agreement. The second step is to shut down unprofitable banks and implement the universal deposit security system. The Single Supervisory Mechanism is expected to solve the problems of the credit institutions with minimum losses for taxpayers and the real economy. If the authorities arrive at a decision, all the financial losses will fall on the creditors’ shoulders. Currently, most of the EU finance ministers feel upbeat about the introduction, but cannot achieve any consensus on the ECB supervisory responsibilities. Besides, the establishment of a fund, which will finance the process of closing or reshaping the unhealthy banks, is rather complicated. Considering the above-mentioned facts, it will be next to impossible to liquidate a bank without any funds.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română