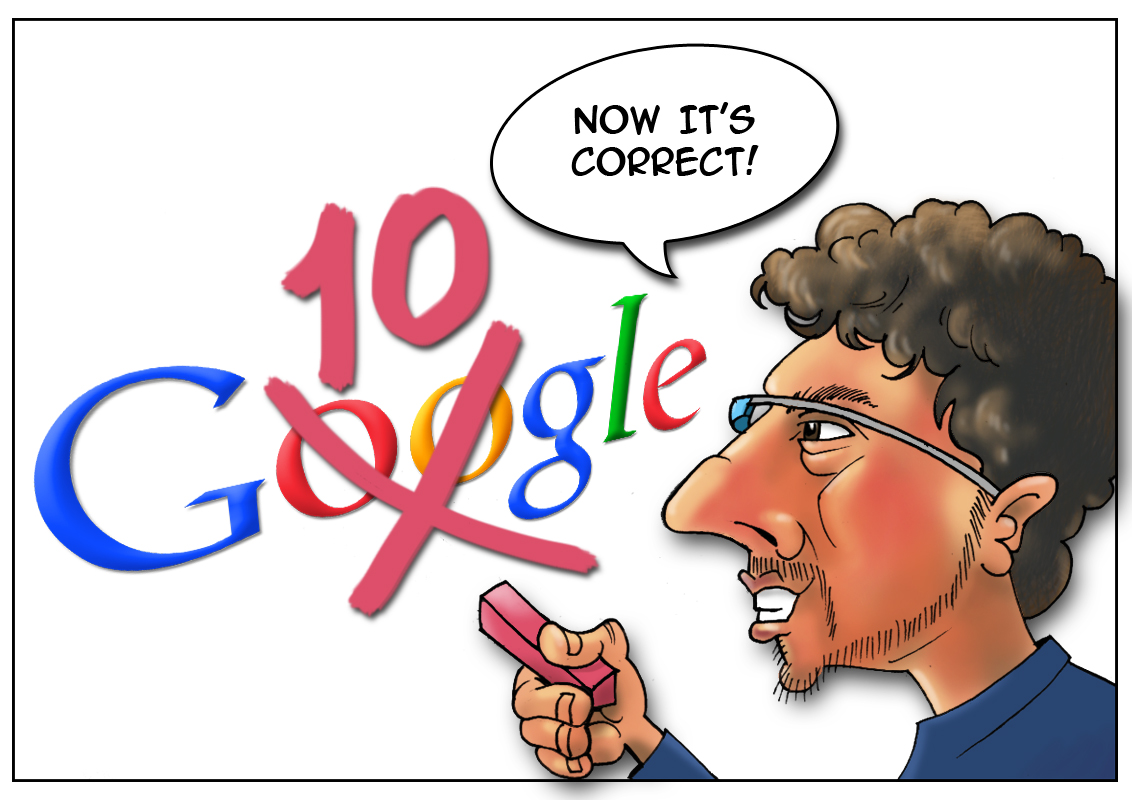

Google shares ended Monday's trading session (August 19) at $865.65. According to the specialists, the company's capitalization remains at the level of $288 billion. It means that Google stock has risen in price tenfold for the last 10 years. This multinational corporation has been steadily increasing posting growth even in the time of the world's financial crisis. Despite the above-mentioned statistics and company's leadership in the total value of assets on the market, the company is inferior to internet giants in terms of other parameters. For example, the analysts are making rather disappointing forecasts on one of the key indicators, Google's ratio between the real value and anticipated next year revenue. Here are several examples. Online retailer Amazon’s forward price-to-earnings ratio is estimated at 135, Facebook’s one – at 44, while Google has only 18. In 2004, when the corporation was getting to first base with capturing the market, this index was at the level of 65. That year, one company's share cost only $85 against current $865.65. In the experts’ opinion, Google will be predominating in this section of the market for a long time, but unfortunately, the high-fliers might not earn the most. Presently, the company is the largest and the most popular search engine, which monthly processes 41 billion and 345 million requests. Moreover, it indexes more than 25 billion web pages and uses 195 languages.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română