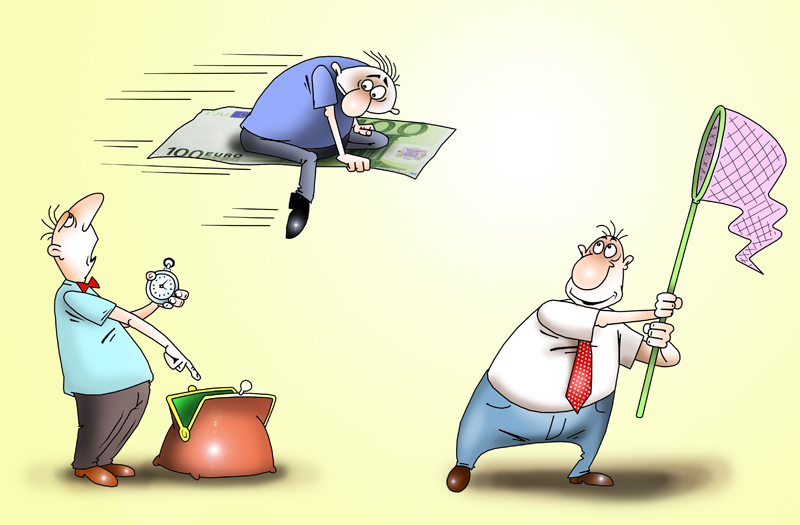

On September 1, The Financial Times reported that Italy has become the first state which implemented a tax on high-frequency trading. The tax got valid since September 2. From now on, traders have to pay the tax amounting to 0.02% from each exchange deal that is effected after the ceiling amount of deals has been settled on condition that both deals and cancel orders are completed faster than in half a second. Moreover, Italy is going to apply levies on trading equity derivatives. The new taxes will be collected regardless of a company’s activity or stock market where a trade is going on.

According to the newspaper, such a novelty aroused criticism from Italian bankers and traders who point at the trade decline at local exchange markets.

Apart from Italy, similar taxes and levies might be introduced in other countries of the EU as well. All in all 11 states in the eurozone stand for such measures. The legislative framework could be provided for levies on financial transactions in 2014. For exchange deals, banks and traders use special algorithmic programs that are able to complete tens of thousands trades per second. However, using automated trading could be risk bearing. In 2012, American broker Knight Capital lost $450 million due to a glitch in the software.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română