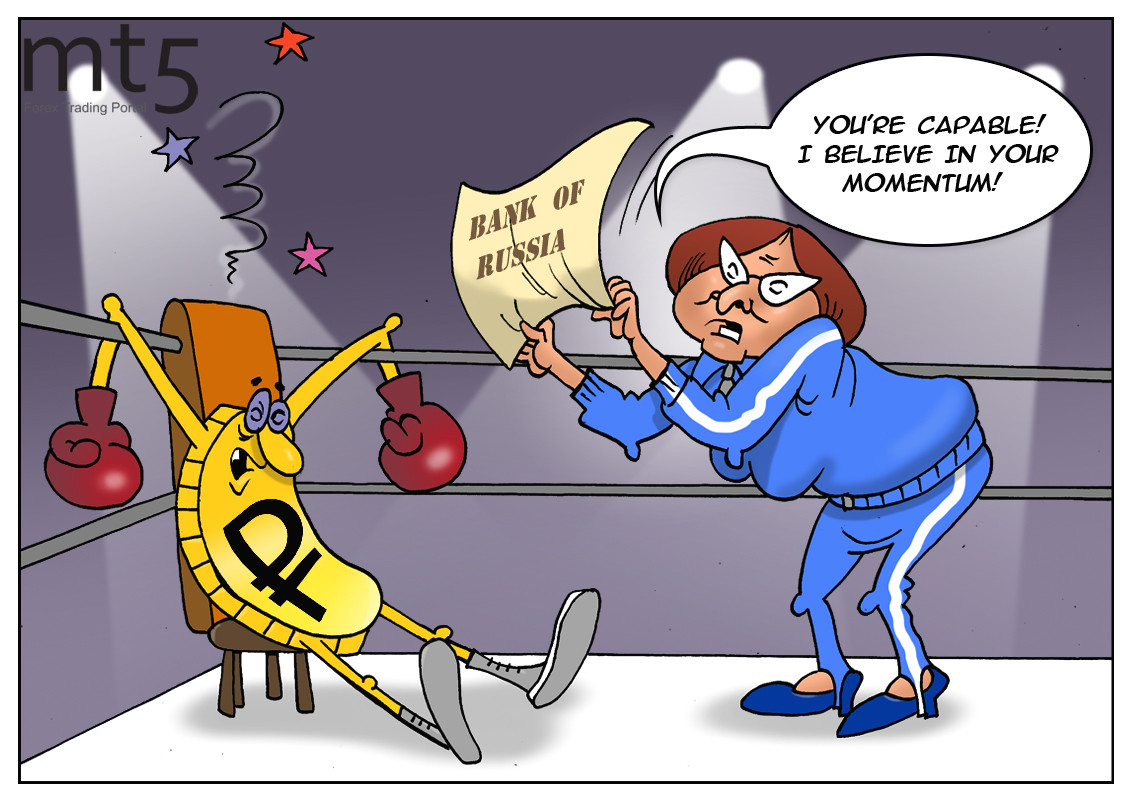

The Russian ruble has been plumbing new depths amid a nosedive of oil quotes. Nevertheless, one of the weakest currencies arouses some interest among foreign investors. It is the common practice on Forex to buy an asset at its extreme lows, betting on its further increase. Strike while the iron is hot. The Bank of Russia was the first to grasp this opportunity. In April, the regulator set about selling big volumes of foreign currency within the framework of forex interventions. At present, some foreign speculators are planning to profit from the collapse of the Russian ruble. “It's the best time to buy emerging markets in over 20 years,” Charles Robertson, the chief economist at Renaissance Capital, said in an interview. “This is the cheapest opportunity since the last time everyone hated EM after the Asian crisis and Russian default.” The EM currencies’ rates are very low nowadays, thus offering lucrative investment opportunities. Charles Robertson advises traders to consider investment in the South African rand, Mexican peso, and Brazilian real. These currencies have been the worst hit this year. However, they have better prospects for recovery than the Russian ruble. The expert from London is cautious about the ruble which could come under the spotlight in the medium term on condition that oil prices will rebound at least up to $45 – 50 per barrel. To sum up, sell-offs of EM currencies will end soon because the IMF and the World Bank want to shore up a lot of ailing developing countries. Besides, the US President advocates for a cheaper dollar. For these reasons, it makes sense to include EM currencies in a portfolio.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: