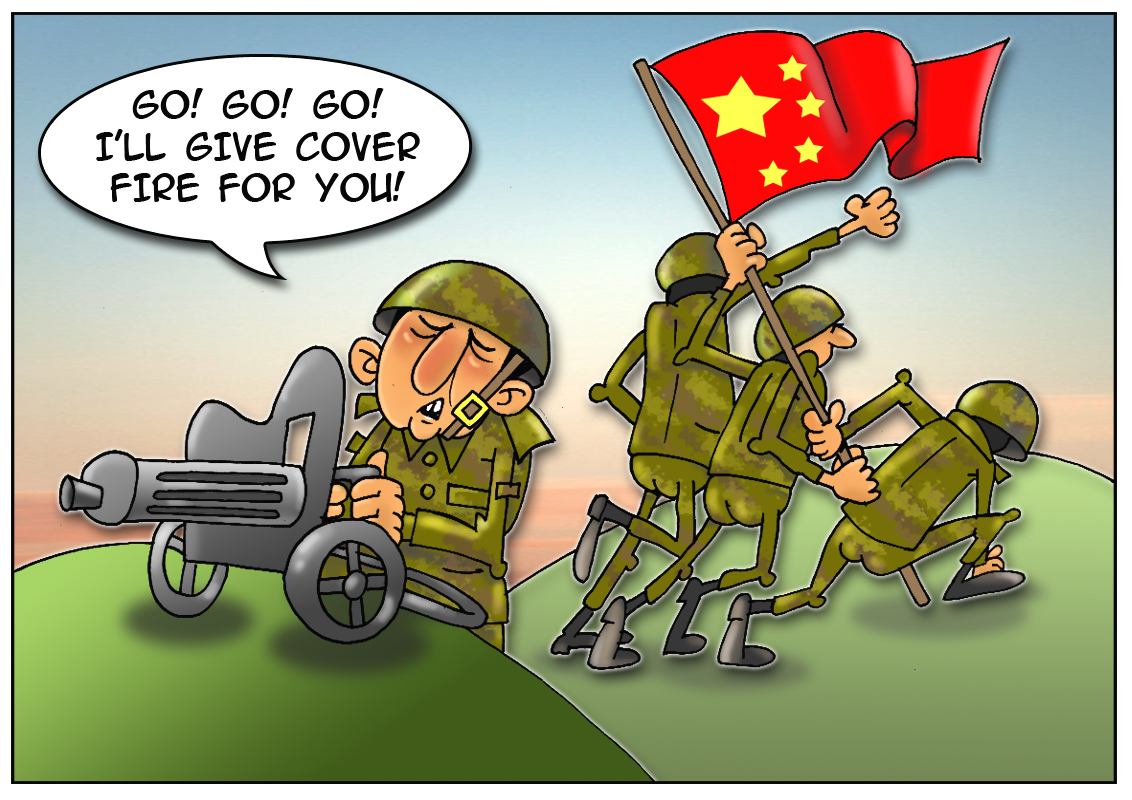

The Chinese investors are increasing their presence in flash points at a steady pace. While in Africa and Middle East there is a strong confrontation between an opposition and government or even a civil war, businessmen use the opportunity to earn. A few days ago, the Chinese oil company Sinopec announced a deal with American corporation Apache. The latter sold a 33% stake in its Egypt oil and gas business for $3.1 billion. Recently, more and more energy enterprises start buying assets in unstable areas. The Western and American companies are afraid to develop business in such regions and avoid to invest large funds in exploitation of natural resources. In contrast to them, the Chinese are ready to risk. For example, in Egypt the most part of oil fields is located on the outskirts of the country and the production has never been suspended for the reason of public disturbances. Unlike the Russian colleagues, Sinopec follows the principle of “buying foreign assets to satisfy China's demand for energy, however it prefers to be a minority shareholder in order to reduce risks”. The Empire is the second world's largest consumer of energy, and Beijing officially supports such a patriotic attitude inside the country. Thus, if public disorder threatens commercial property of its national companies, Beijing can put military pressure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română