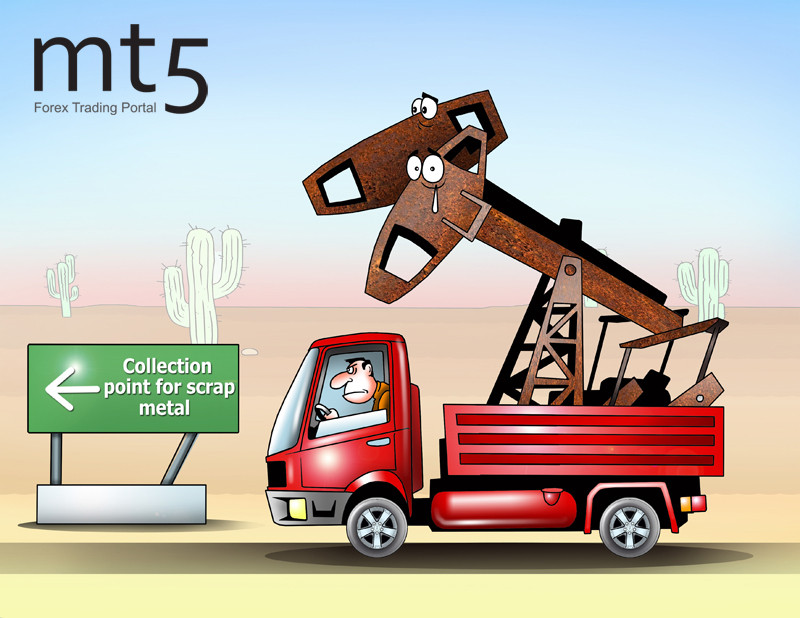

The US oil market is in a state of collapse. From Monday to Tuesday, April 21, WTI, Texas light sweet, unexpectedly fell in the negative territory. WTI futures contracts for May delivery dropped below zero to $-37,63 per barrel for the first time since 1983. A decrease in the number of active oil rigs in the United States has only exacerbated the situation.

On Wednesday, April 22, WTI crude oil which had not yet recovered from shock was traded at $11,40–$11,50 per barrel. A day earlier, it cost around $16 per barrel. Current challenges have affected American energy companies deeply urging them to limit the number of active rigs drilling for oil. According to analysts, oil installations plummeted to the lowest level in four years.

The number of platforms has been declining from the beginning of this year, especially since oil prices halved. Even efforts of the US oil manufacturers aimed at reducing production to limit excess supply caused by the COVID-19 pandemic have not improved the situation.

Experts at Baker Hughes, an oilfield services company, have estimated that the number of drilling rigs shrank by 66 to 438 for the week ended April 17. According to statistics, the number of oil platforms dropped by 47% in 2020 compared to the previous year. In 2019, this figure equaled 825 units.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: