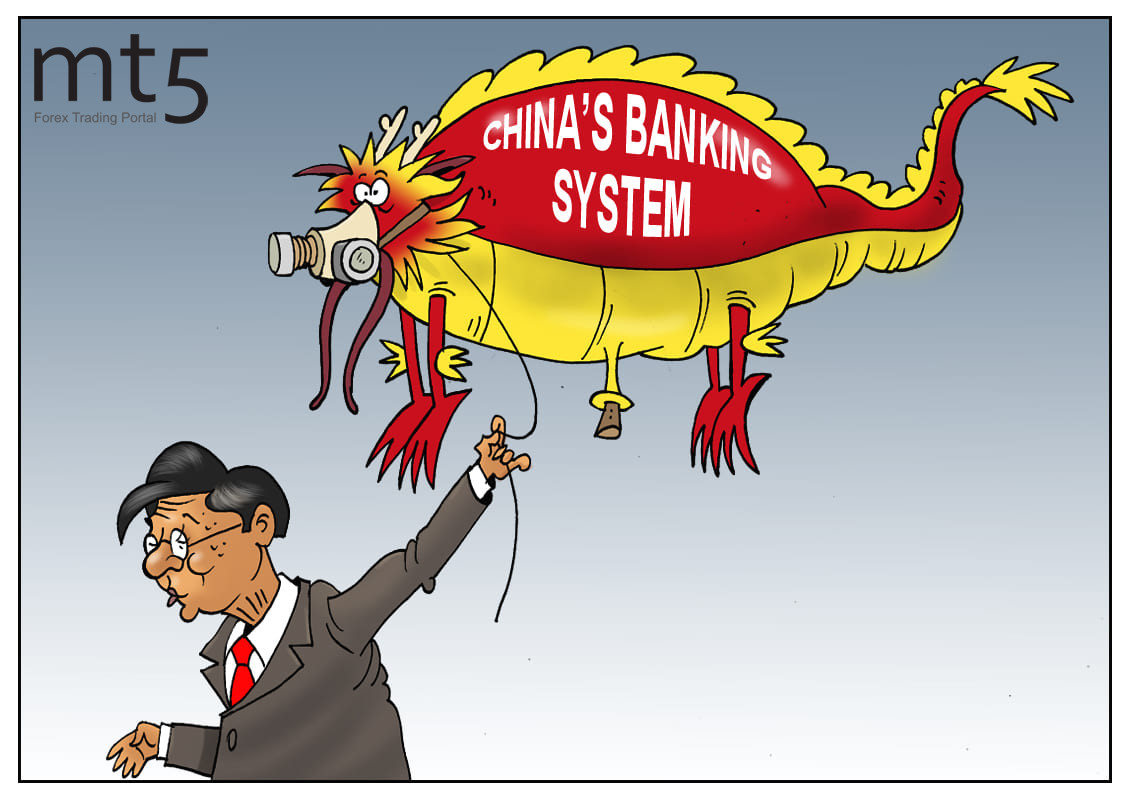

As expected, the People’s Bank of China refrained from reinventing the wheel, but simply took the cue from more experienced world regulators. The local central bank followed suit and began to pump up liquidity into its banking system, while reducing the interest rate on its targeted medium-term lending facility (TMLF) to 2.95%. This time, China's craving for plagiarism proved to be useful for the country. At present, all the countries are struggling to strike a balance between spending needed to combat the pandemic and the economic losses related to the shutdown. In this regard, China is no exception. Moreover, given the fact that the country's economy depends heavily on the strength of its manufacturing sector, China seems to have faced the nightmare caused by the coronavirus outbreak. For now, the local central bank's officials are optimistic about the future and believe that the country is unlikely to repeat the Great Depression. However, they do not rule out this scenario. “The possibility of a ‘Great Depression’ cannot be ruled out if the epidemic continues to run out of control, and the deterioration of the real economy is compounded by an eruption of financial risks,” Director-General of International Department at the People's Bank of China Zhu Jun said. Notably, the last Great Depression started with the Wall Street crash in 1929, which led to the freezing of credit markets, massive bankruptcies, as well as a sharp decline in US GDP of more than 10 percent and unemployment that reached 25 percent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: