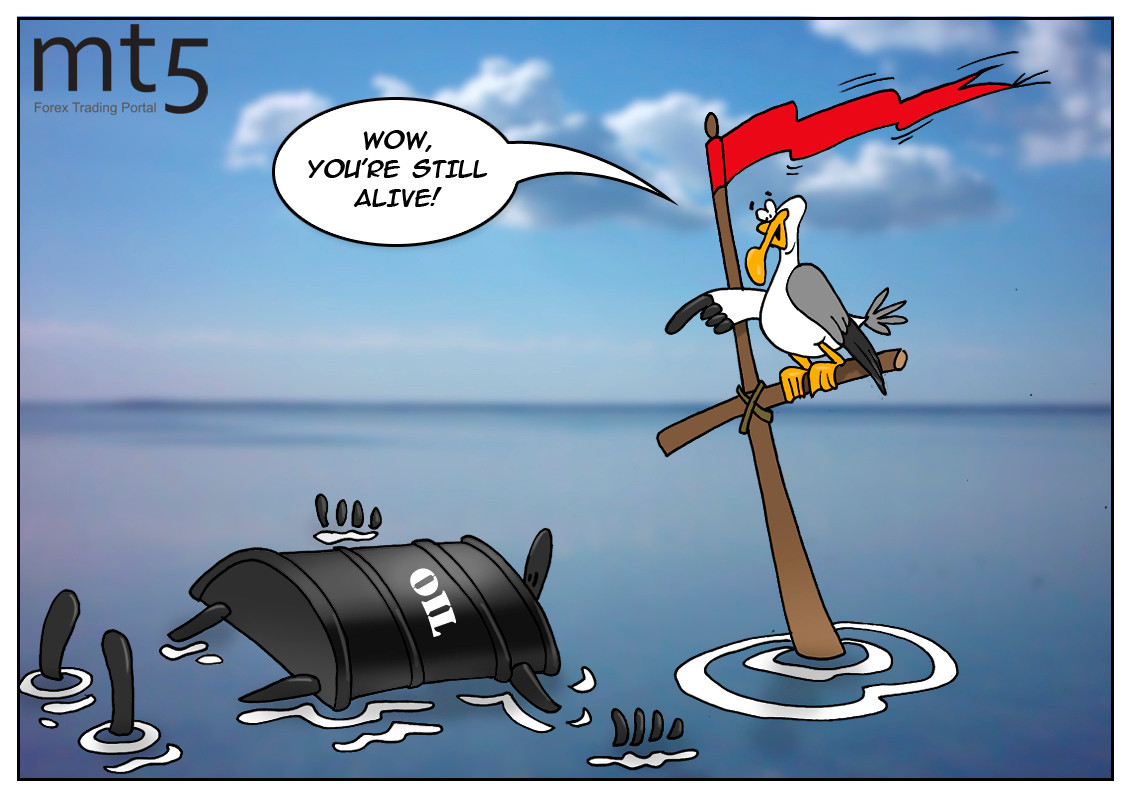

After a historic crush, the oil market is showing green shoots of recovery. Traders are again ready to take the risk hoping that the demand for oil will gradually recover amid a decline in its output. Brent crude climbed by more than 10%, while WTI added almost 15%. Additionally, oil prices went up amid the rising tension in the Middle East. President Trump warned Iran that the United States would destroy any Iranian gunboats that harass American ships at sea. However, many experts suspect that Trump’s words are not a real threat but a clever attempt to boost oil prices amid geopolitical tensions. And it worked out well. Oil prices rose after his statement. Besides, they gained additional support from the data that showed a decline in the number of operating drilling rigs and the oil output in the United States. Many US energy companies have already taken an axe to their rig numbers. Currently, there are just over 400 rigs in the US. Their full capacity totals 12.2 million barrels per day, the lowest level since June 2019 and less than its record peak of 700,000 barrels in March. Naturally, it is too early for the oil market to regain its footing. Now, there are a lot of negative factors that continue to weigh on oil quotes. Nevertheless, oil prices seem to have bounced off the bottom.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: