The Dow Jones Industrial Average which has 30 components in the leading U.S. companies is passing through the most significant reform since 2004, S&P Dow Jones Indices announced on September 10.

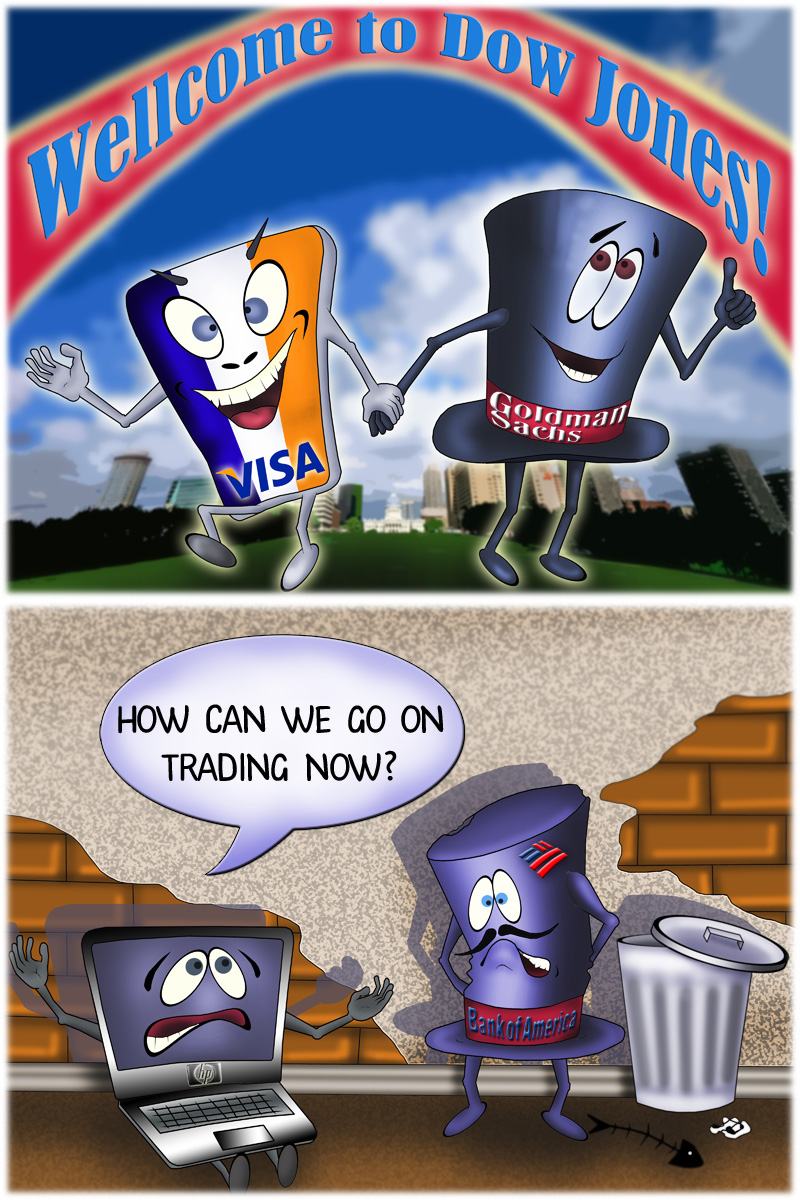

Bank of America, Hewlett-Packard and Alcoa have been dropped. Goldman Sachs, Visa and Nike will replace them.

According to The Wall Street Journal, the reason for the adjustment is low stock prices of the departing components, and diversification of the sector and industry group representation. The Dow Jones’s peculiarity is that it is composed of the highest priced common stocks of the U.S. companies, but not in accordance with their market cap.

Securities of the leaving corporations do not satisfy S&P Dow Jones Indices criteria. On September 10, Alcoa’s shares edged up to nearly $8, H-P ticked up to $22,2, Bank of America’s shares gained to $14.6 per share. Comparing on September 11, the quotes of Visa added to $184, Nike was up to $66, and Goldman Sachs rose to $165 apiece.

S&P Dow Jones Indices has not included Google and Apple in the chanced index, which shares are traded above $500. Bloomberg were citing David Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, who said the price of their shares is too high.

S&P Dow Jones fears that high prices can distort the Dow index and make it not representative.

The renewed index will consist of five financial and five leading industrial companies.

The Dow Jones Industrial Average has existed since 1896. It is considered as a barometer of the U.S. economy condition. In recent years, investors have put the focus on more representative and flexible S&P 500 index, which includes the components with the highest market capitalization.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română