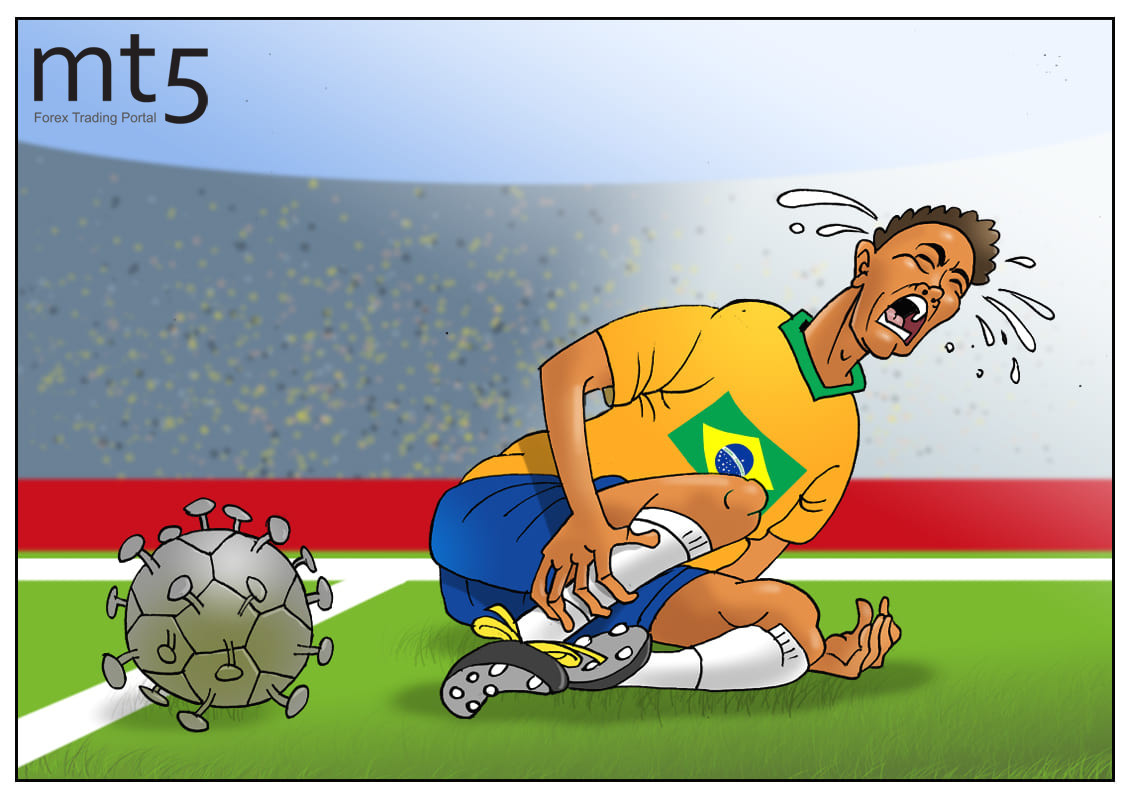

Unlike its Iranian counterpart, the Central Bank of Brazil decided to cling to the traditional method. While Iran's government resorted to an innovative move and approved a plan to rename its national currency, Brazil's central bank slashed its benchmark interest rate to a new all-time low. The threat of a serious contraction in the largest economy of Latin America amid the coronavirus pandemic forced the regulator to revise its monetary policy. The Selic interest rate is currently only 3% per annum, the lowest figure over the last three years. However, analysts suspect there is more to come. According to the Committee, the regulator does not intend to stop and another rate cut can be expected in the near future. Policymakers said that they were considering a final monetary adjustment for the next meeting and it would not exceed the current one. Besides, they added that the fiscal scenario and economic data would be crucial to determine the stimulus length. Given the fact that the Brazilian economy is anticipated to face the biggest crash in at least half a century, the interest rate will undoubtedly be lowered again. At the next meeting, all nine members of the central bank's monetary policy committee, known as Copom, will most likely unanimously support a rate cut, since its two members have already proposed a more dramatic reduction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: