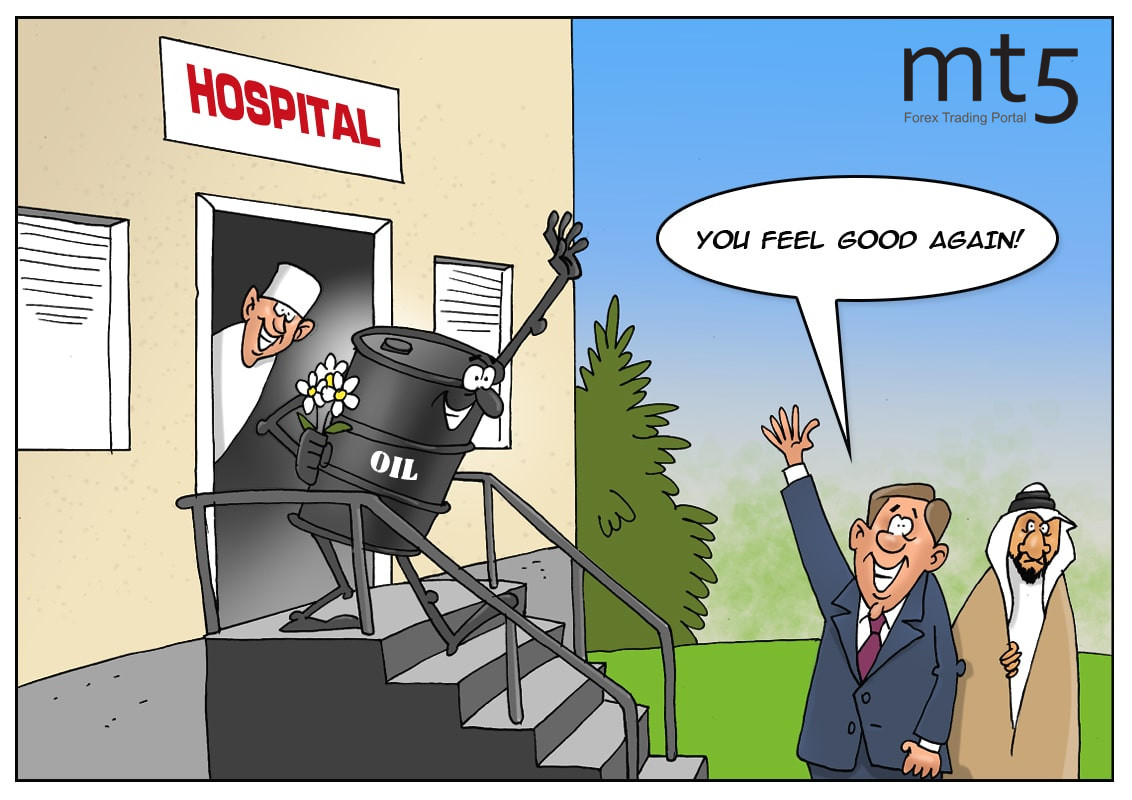

According to mass media, the global oil market is experiencing a gradual advance. Global benchmarks for oil prices are breaking March highs. For example, Brent crude confidently broke the level of $40 a barrel whereas WTI futures at the moment cost more than $37 a barrel. The strangest thing is that there were not enough reasons for such a rise in oil prices. Thus, the OPEC+ agreement on oil output reduction expires rather soon and there is no information about its future. Besides, the oil demand recovery has just begun and will take a lot of time to approach the pre-crisis levels. Moreover, oil storages are still full. Nevertheless, oil prices are climbing. At the same time, market participants are really optimistic. They hope that Russia and Saudi Arabia will be able to agree on extending the current deal for at least one or two months. Notably, these hopes are not groundless. Both countries have already negotiated the issue and Russia is expected to give an answer in the near future. Besides, a gradual revival of global economies may boost both oil demand and prices.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română