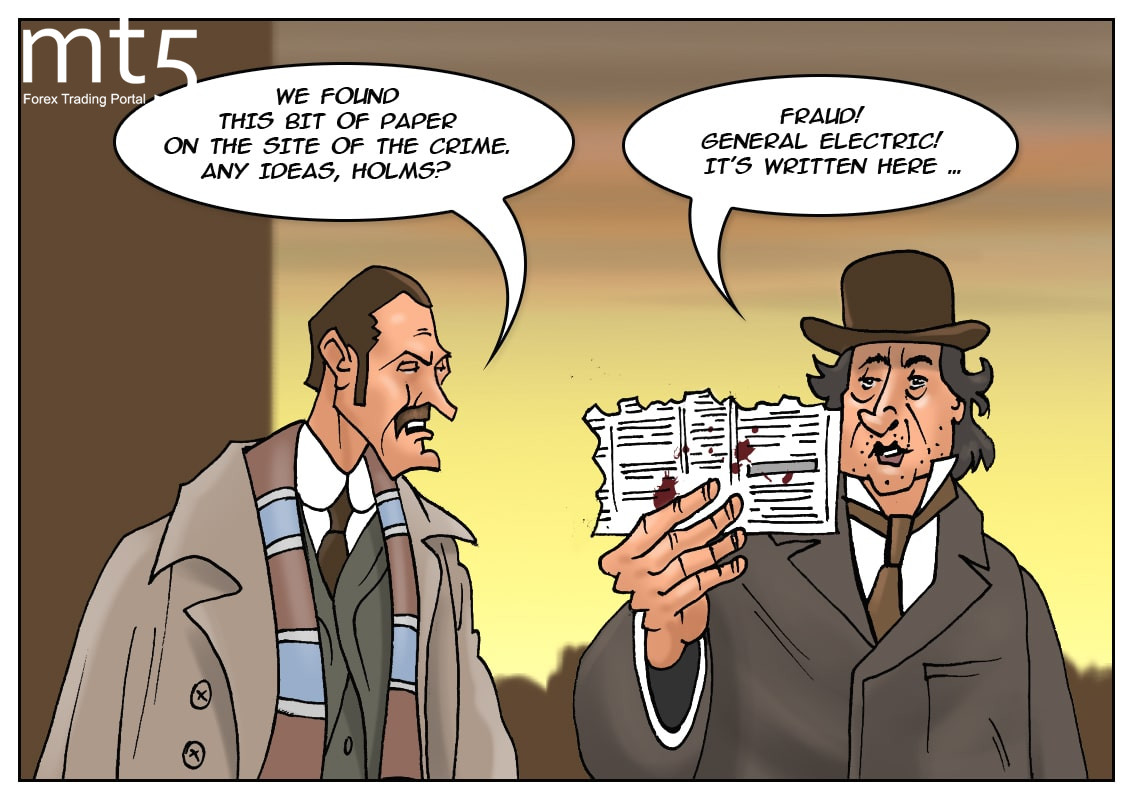

Tax watchdogs relentlessly monitor interest deductions from small and big companies. Therefore, they will charge a company regardless of its caliber if it does not pay taxes. Reportedly, American industrials giant General Electric is being sued by HM Revenue & Customs over allegations of tax evasion. HMRC believes that in the period of 2004 to 2015 tax deductions by six of the firm's group companies, including GE Capital, were wrongly claimed. Tax deductions fraud amounts to $1 billion. HMRC points out that General Electric has applied for tax benefits in the UK and Australia at least twice while providing false claims. The lawsuit against GE was filed in 2018. Nevertheless, the case is still ongoing and, apparently, it will not end soon. In addition, GE has launched a countersuit against the tax authority in an attempt to end the proceedings. "GE complies with all applicable tax laws and judicial doctrines of the UK, where we have operated for more than 100 years and where we employ around 16,000 people. We make sure that large businesses, just like everyone else, pay all the taxes due under UK law and we don’t settle for less", the company said. In its filing for the Securities and Exchange Commission (SEC) in 2018, GE offset the potential impact of the lawsuit and secured about $1 billion, excluding interest and penalties.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română