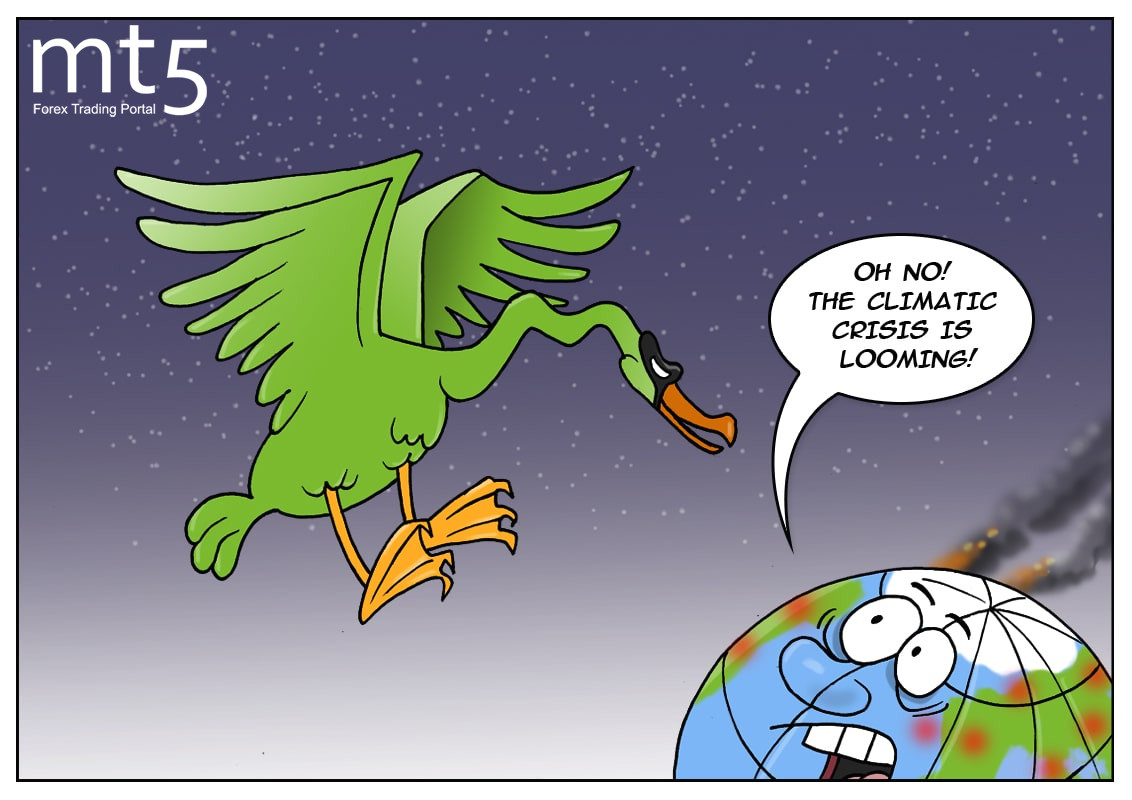

From time to time, the global economy suffers from risks posed by the swans of different colors: white swans, black swans, and now even green swans. The swan concept implies a situation or an event that may deteriorate the economy. For instance, COVID-19 is a black swan event. Black swan events are seen as unexpected occurrences that are hard to anticipate. Besides, they cause long-lasting impacts. While the coronavirus black-swan event is waning, market experts are warning about the green ones. Green swans are climate-related risks. Nowadays, only the US is taking the problem of climate change very seriously as calamity caused by nature may trigger cascading effects within markets and the global economy. Yet, experts still consider green swans more like risks of the remote future. For this reason, the Bank for International Settlements has issued a call to the central banks around the globe to push governments to introduce strong policies to ease global warming. The bank warned major investors, central banks, rating agencies, insurers, and leading economists of a serious economic downturn against the backdrop of climate change. "There is certainty about the need for ambitious actions despite prevailing uncertainty regarding the timing and nature of impacts of climate change," the paper says. "For safety's sake, US financial regulators must prepare and adapt," Democratic Senator Sheldon Whitehouse stressed. However, the White House believes that there is no need to address this issue at the legislative level. Senate majority leader Mitch McConnell stresses that the climate bill will not see the light in the Senate until he is at the helm. Despite such a controversial attitude to this problem, the US is at least openly discussing it while other countries either ignore it or wrestle with the coronavirus crisis.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română