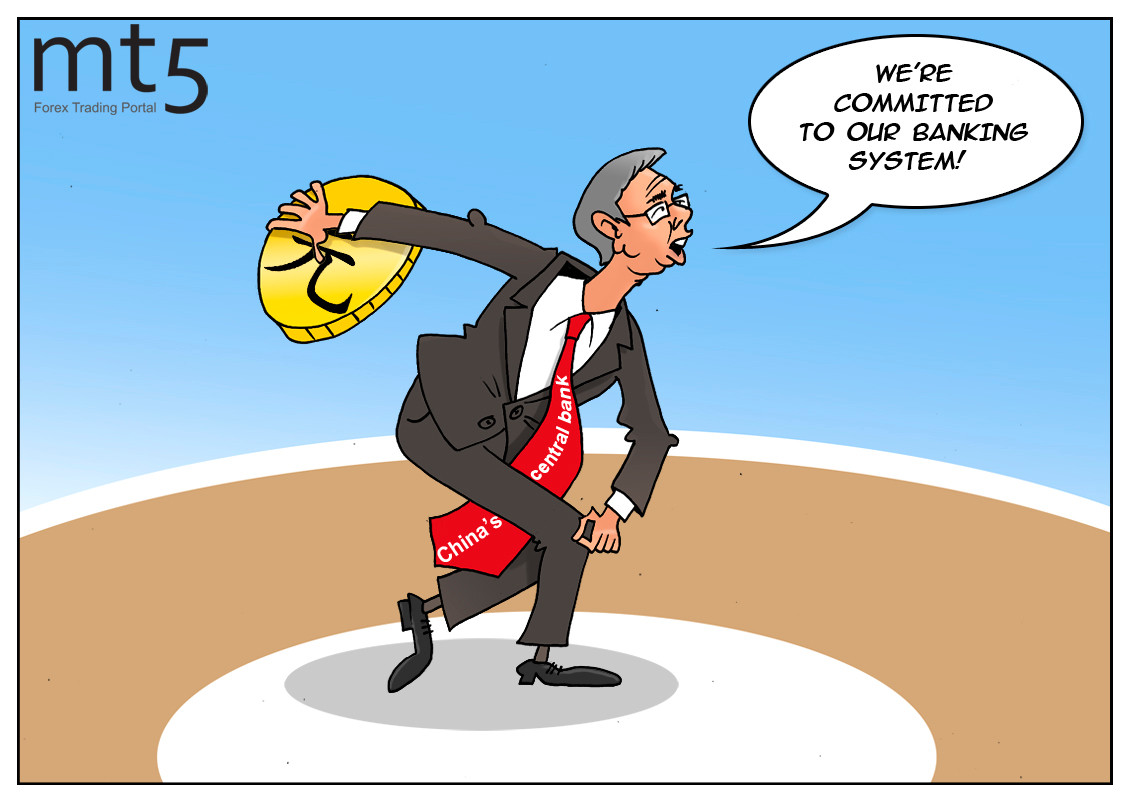

The People's Bank of China, like the majority of other financial regulators across the world, is trying to overcome the economic fallout from the coronavirus pandemic. Financial institutions are injecting a record amount of cash into the banking system in efforts to mitigate an adverse impact of the coronavirus. Numerous stimulus measures aimed at supporting the economy involve pumping up the system with easy money. Despite the difference in the system approach, China is not an exception.

Thus, the local central bank injected 150 trillion yuan ($21.1 trillion) worth of liquidity through seven-day reverse repos keeping the key interest rate at 2.20%. Such a large amount of money is needed to maintain liquidity in the banking system at a reasonably sufficient level. In addition, the central bank will have to repay reverse repos.

China is still facing the consequences of the pandemic. Moreover, negative factors may only aggravate the situation. According to Yi Gang, the Governor of the People's Bank of China, the regulator needs to use various monetary policy instruments to ensure sufficient liquidity and to enable M2 money supply and aggregate financing to grow at notably higher rates than last year. This means that the People's Bank of China is likely to pump more cash into the banking system in the near future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română