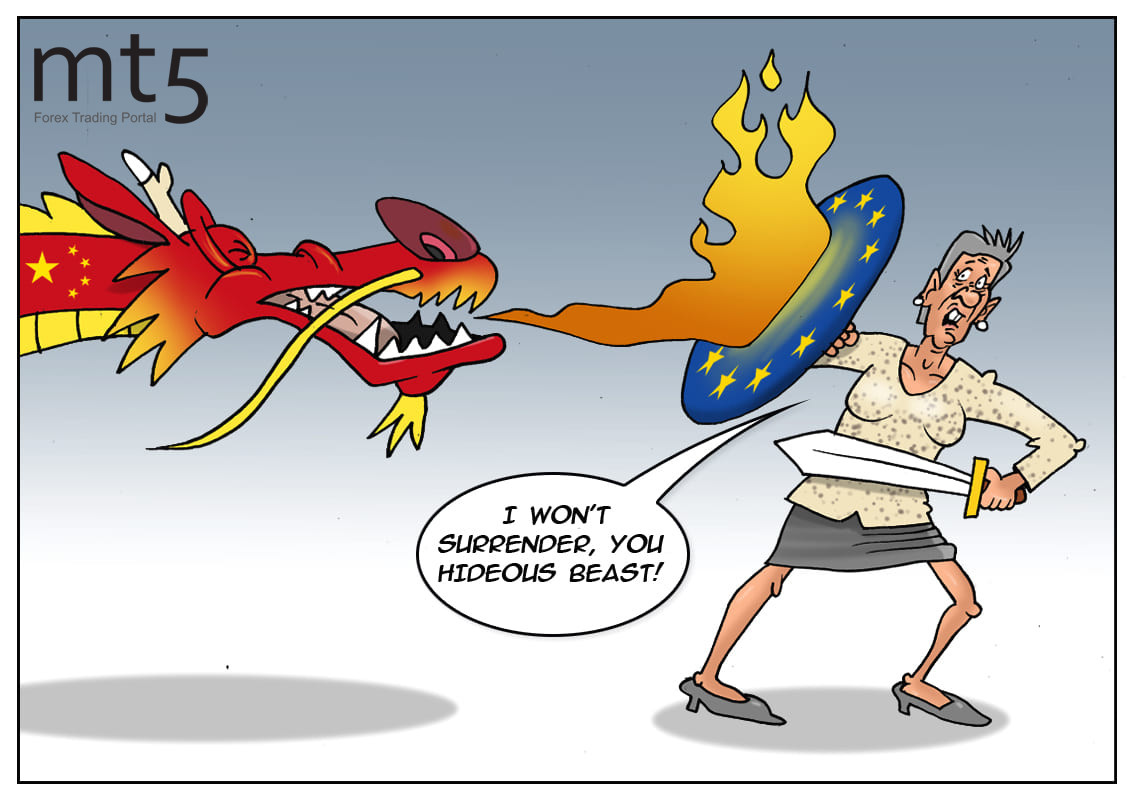

China’s efforts to reinforce its presence in Europe raised concerns in the European Union. It is well known that Beijing has long been acquiring large and medium-sized enterprises around the world. However, the authorities argue that the companies which takeover foreign businesses are commercial. This type of economic expansion leads to unfair competition between firms. Therefore, those countries that are able to manage without Chinese investment try to prevent takeovers of strategic companies by foreign purchasers.

The United States was one of the first to express discontent with the situation. Then Europe joined and tried to counter the threat of China’s expansion. Amid the sharp economic downturn caused by the recent coronavirus outbreak and steep falls in share prices of European companies, Beijing was buying up local businesses. However, when the pandemic hit its peak and China made an attempt to takeover pharmaceutical laboratories, EU officials stepped in. "We want to be in control within our own territory", EU Competition Commissioner Margrethe Vestager said. "When it comes to foreign subsidies we have absolutely no control and no transparency", she added. New regulations on foreign direct investment may ban some firms from acquiring European assets or force them to cancel purchases.

The pandemic resulted in the greatest economic crisis for EU countries in the past hundred years. Eurozone GDP slumped by 3.8% in the first three months of 2020. According to Manfred Weber, a German lawmaker who heads the centre-right EPP grouping in the EU Parliament, the many are "extremely concerned that China will benefit from the economic recession in Europe." He is sure that the EU urgently needs laws to ensure a strong approach to foreign investment screening amid the increased vulnerability of local businesses.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română