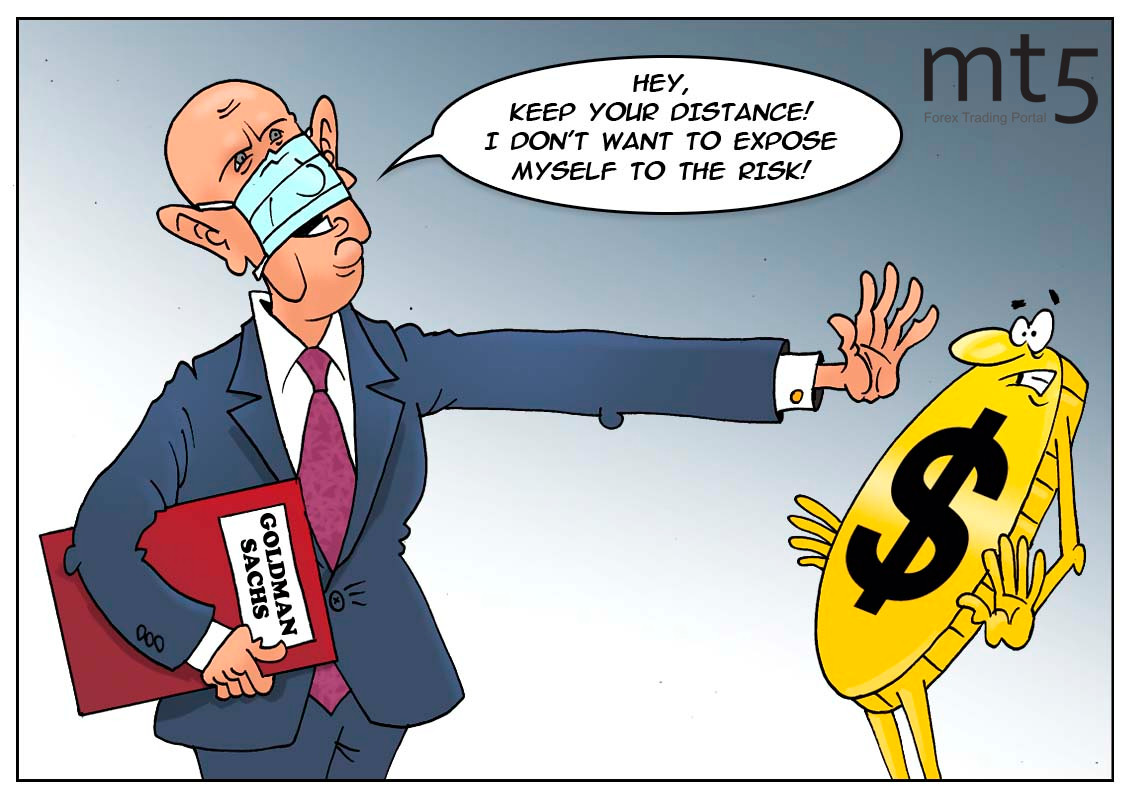

Lately, the US dollar has been rapidly losing its appeal among investors. Analysts are concerned about the future of the US currency as the outlook is getting gloomier every day. Even experts at Goldman Sachs seem to have given up on the US dollar. They doubt that the greenback will be able to recover soon amid the risks associated with political uncertainty and unfavorable epidemiological situation. Such a negative background means an inevitable decline for the US dollar against all other majors. In a note to investors, Goldman Sachs recommended taking short positions on the US dollar. Shorting the currency involves selling it with the intention of buying it back later at a lower price, thus betting on its depreciation. Experts also noted that the odds for the rebound in the US currency were rather low given the delay in coronavirus vaccine development and the upcoming presidential election in the US. According to Ulf Lindahl, the chief investment officer at A.G. Bisset, “the US currency will plunge by 36% against the euro over the next year or so, taking it to levels it has not seen in more than a decade.” The US dollar has already dropped by almost 11% from its 2020 peak against a basket of other major currencies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română