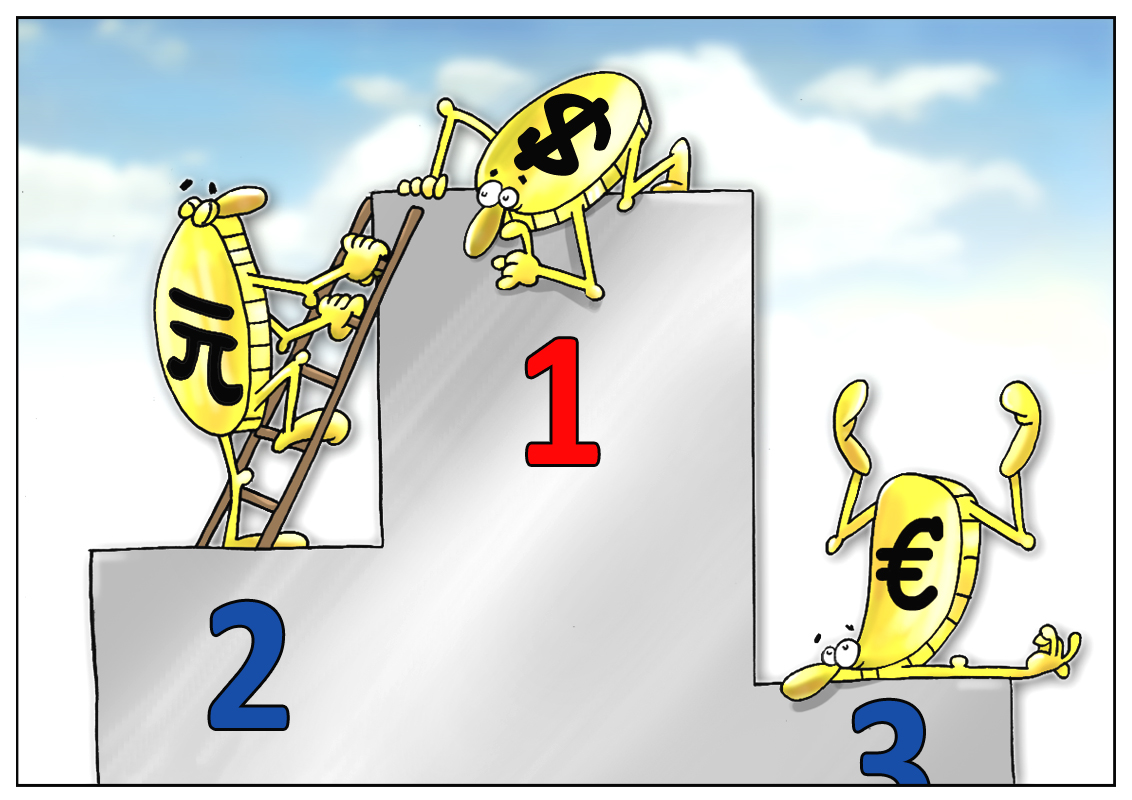

China is rapidly gathering momentum. After a modest fall at the beginning of the year, the Chinese economy could not only to bottom out, but also make up leeway. Meanwhile, the yuan is moving with the trend as the globalization plans are being implemented. According to international agency, currently, the yuan takes the second position among the most actively traded currencies. Complying with the Society for Worldwide Interbank Financial Telecommunication (SWIFT) statement, the share of the yuan in trade finance has surged this year. Thus, in 2012 the indicator clocked at 1.89%, while in October 2013 it jumped to 8.66%. Meanwhile, the U.S. dollar still leads with 81.01% of trade settlements. The euro loses its allure falling from a market share of 7.87% last January to 6.64%. The top countries using the Chinese currency were Australia and Germany (2%), Singapore (12%), Hong Kong (21%), and China (59%). Considering this situation, the Chinese government, which usually adheres to tight currency control, now aims to make the yuan freely convertible by 2015. In the wake of such news, some of the largest European cities are set to ink bilateral agreements with China to boost the international use of the yuan. London, Paris, and Frankfurt-am-Main are among them. Today only Hong Kong has such a benefit, but the yuan’s expansion has just begun.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română