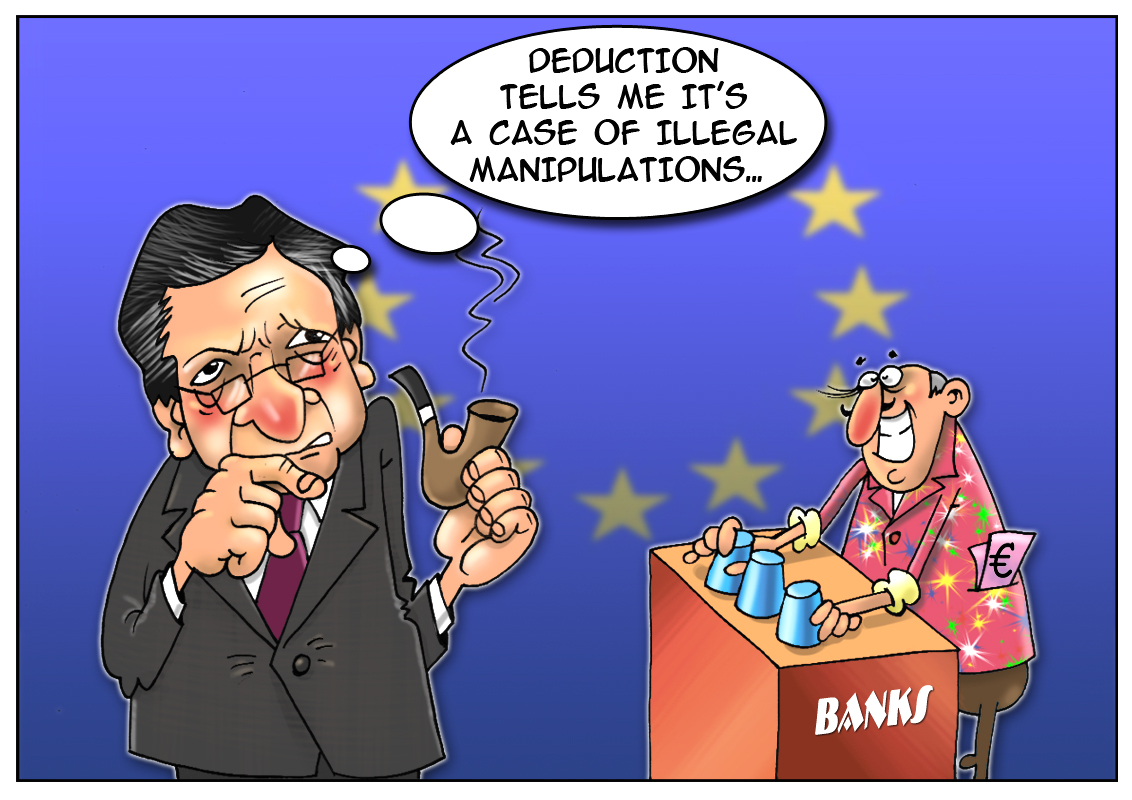

The European Commission's investigators found out a group of people who had manipulated benchmark rates by prior conspiracy. Evidently, ordinary citizens did not have access to such information; it was the people very familiar with the European banking sector. Human rights activists have already dubbed a preparing lawsuit as a case of banking elite collusion. More than ten different financial institutions were involved in scandalous trial on charges of manipulating average interest rates. Interest payments on interbank loans are calculated with these major financial indicators. The banks accused by the EU’s executive arm will pay a total of 1.7 billion euros in fines, the amount which the European Commission punished to settle the most famous U.S. and European banks. The participants of the rigging are the U.S. Citigroup und JPMorgan Chase, Germany's Deutsche Bank, the British Barclays, Royal Bank of Scotland, and the French Societe Generale. The management of these organizations is charged with manipulation of the most important benchmarks for international interest rates — Libor, Euribor, and Tibor. Moreover, this illegal practice affected private borrowers – across the European Union over 40 percent of consumer credit rates are estimated according to these key bank rates. To fully appreciate the scale of the harm from such an action, just look at the number of transactions that are daily concluded in the markets, where the average interest rates are taken into account – it is $500 trillion a day.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română