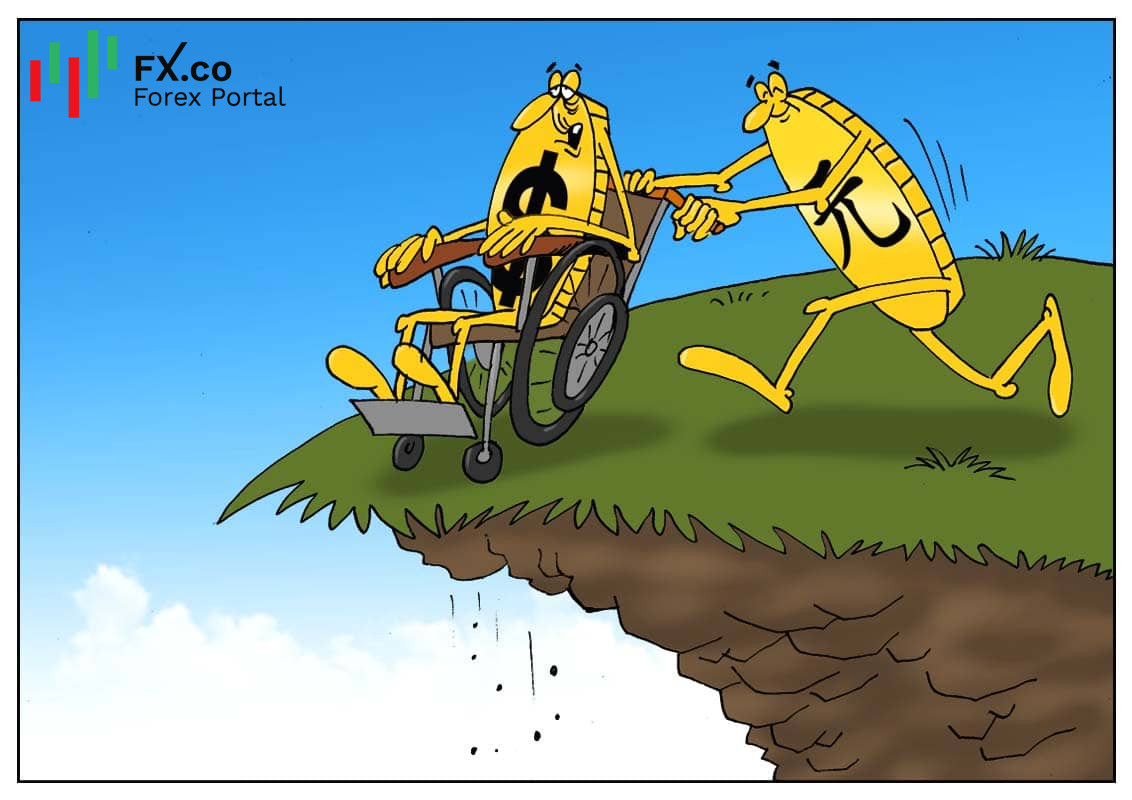

This year, the US dollar has come under strong pressure from the onshore yuan. The latter has been trading confidently at the largest premium over the reference rate since November. Moreover, this trend is just accelerating. Also, the BBDXY index, which tracks the performance of a basket of leading global currencies versus the US dollar, is testing the key support.

At the beginning of last week, the yuan soared against the US dollar, hitting its strongest level over the past three months. The onshore yuan, or CNY, added about 700 points above the fixing, the highest rate since the beginning of November. This trend could hardly be described as short-lived, since the exchange rate has been in the range of 6.4756 yuan per dollar for the second week.

Market participants have been surprised by the reaction of the People's Bank of China. In response to such fluctuations in the national currency, the regulator usually takes measures to limit the yuan’s gains. However, this time, the bank is in no hurry to step in as a stronger renminbi does not have a severe impact on exports. The demand for Chinese goods, primarily for medical products, remains high. This means that the yuan strength does not dampen the country's economic growth.

This month, the yuan is likely to continue edging higher against the US dollar, and the American currency will hardly be able to withstand this downward pressure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română