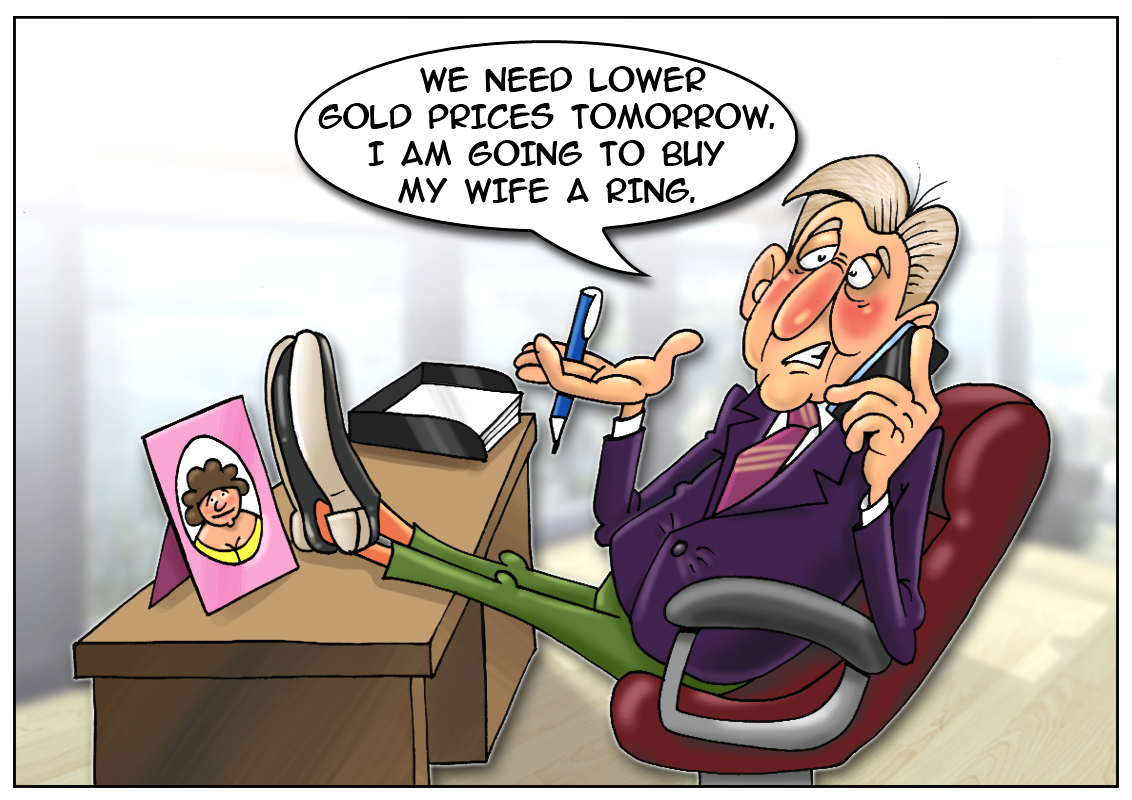

Just five financial institutions are involved in setting a global benchmark price of gold. As a result of long-lasting scrutiny, special investigators from the U.K. Financial Conduct Authority and other regulators eventually discovered that only five banks deal with forming the world market price of the precious metal. It took almost 100 years to scrutinize a long chain of schemes and frauds. Experts managed to find out that the formal procedure of a price determination and supervision in this economic sector remains unchanged since 1919. For your reference, here are some facts to understand the massive scale of such a mechanism. Well, every business day at 10.30 and 15.00 GMT banks around the world publish initial values at which gold is sold and bought. After receiving the information, for 10 minutes the banks consider a current benchmark rate of the precious metal. The procedure of assessing one ounce of gold is called fixing. Recently, market participants have noticed a number of coincidences; for example, it was revealed that the biggest number of gold deals was executed immediately after fixing. Considering these cases, it should be asserted that the dealers and their clients are using information from the talks to bet on the outcome. Such banks as Barclays Plc, HSBC Holdings Plc, Bank of Nova Scotia, Societe Generale SA., and Deutsche Bank AG (DBK) take part in fixing a price of gold. The benchmark rate is used by mining companies, jewelers, and central banks to buy, sell, and value the metal. A lot of investors and financial institutions estimate their own reserves in the gold equivalent. It should be reminded that according to World Gold Council, the ounce of golf was valued at $1,326 in the third quarter. The precious metal’s cost dropped 20% this year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română