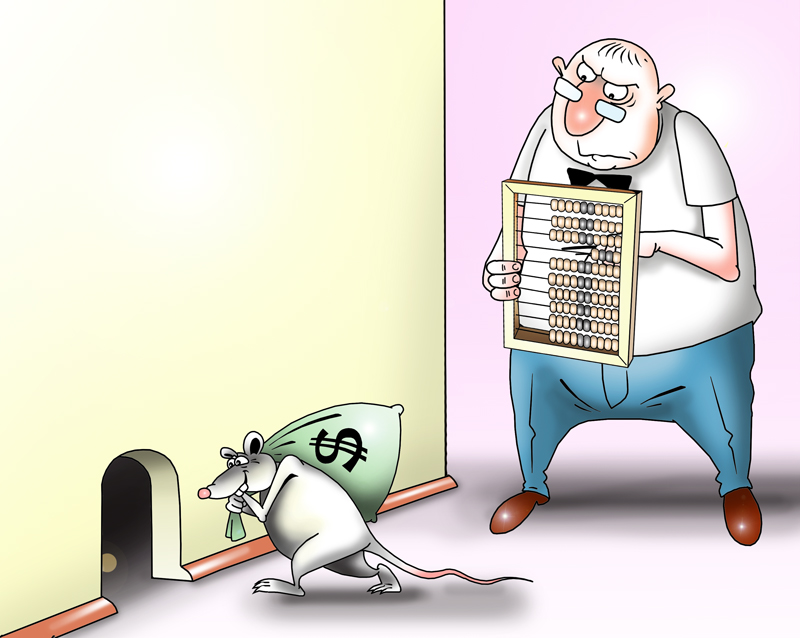

Losses of US budget due to vulnerability in tax legislation for wealthy citizens have been about $100 billion since 2000, according to Bloomberg, citing Richard Covey, the lawyer who found the problem in the legislation.

In 1990, Covey suggested transferring funds of wealthy Americans to a trust fund for no more than two-year period and then return it back as a present, to avoid Estate and Gift taxes. According to the legislation, the gift to oneself is not levied. Nowadays in the US Estate and Gift taxes are applied if the sum exceeds $5.25 million. Offered by Covey mechanism has been widely spread in the US, JPMorgan Chase & Co. (JPM) opened a special brunch to operate the trusts, the Estate and Gift taxes are virtually not paid.

Facebook Inc. (FB) Chief Executive Officer Mark Zuckerberg, Lloyd Blankfein, the CEO of Goldman Sachs Group Inc., and fashion designer Ralph Lauren are among the business leaders who use tax shelters, which may up to 40%, filings show. By shuffling company stock in and out of more than 30 trusts, Sheldon Adelson, the owner of Las Vegas Sands Corp., given at least $7.9 billion to his heirs while legally avoiding about $2.8 billion in US gift taxes since 2010.

The news agency notes that since 2009 some Democrats, including Barack Obama try to solve the problem, however, the suggestions are not supported by Republicans, insisting on abolishment of Estate and Gift taxes.

Congress enacted the estate tax in 1916 to apply to large fortunes at death. 8 years later, it added the related gift tax to cover transfers made before death. Since 2000 the US Treasury got $300 billion.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română