Curiously enough, Moscow is prone to label highly-reputable Western news agencies as crooked mass media. The Financial Times or The Washington Post with their teams of recognized experts are allegedly dancing to the tune of authorities. The reason is obvious. The Kremlin with its hardline policy does not tolerate any criticism by Western experts in economics and politics and journalists stating official rhetoric. At the same time, when a little-known resource praises dubious achievements of Russian officials, it is presented as a heavyweight periodical. Schiff Gold is no exception.

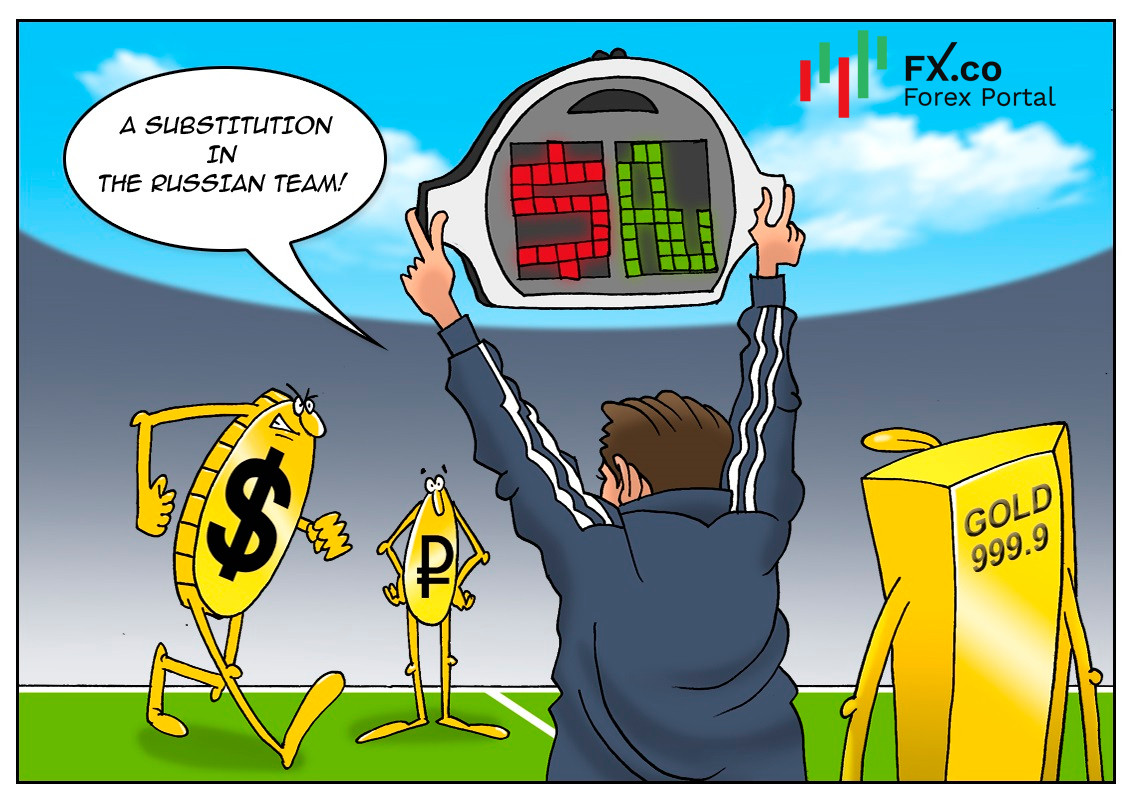

Analysts of this no-name Internet portal posted a material about efficiency of the anti-dollar maneuvers in Russia. In response, the pro-Kremlin media interpreted this statement from their angle as though the US authorities had acknowledged the efficiency of the anti-dollarization campaign unleashed by Russia. Indeed, isn’t it a matter of pride for Moscow? The US authorities through Schiff Gold highly praised the Kremlin’s idea of giving up the US dollar and its implementation! The trend of abandoning the US dollar originates in Russia, Schiff Gold reminds its readers. Back in 2014, Moscow was the first to cut down on the US currency in its foreign currency reserves in favor of gold. Following this strategy, Russia even managed to outpace China in 2018 and was ranked the 5th largest gold holder in the world for a short time. From now on, any country buying gold not just tops up its reserves with the precious metal but puts into action the Russian idea. Recently, Poland unveiled the plans to replenish its gold and forex reserves with 100 tons of gold. Analysts at Schiff Gold think this intention confirms the trend.

Mulling over the success in the de-dollarization campaign, do not forget that nowadays the US dollar accounts for a mere 54% of the forex reserves worldwide. However, analysts at Schiff Gold are certain, once a number of countries are making concerted efforts to minimize exposure to the dollar, the share of the US currency in the global reserves will shrink notably by late 2021.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: