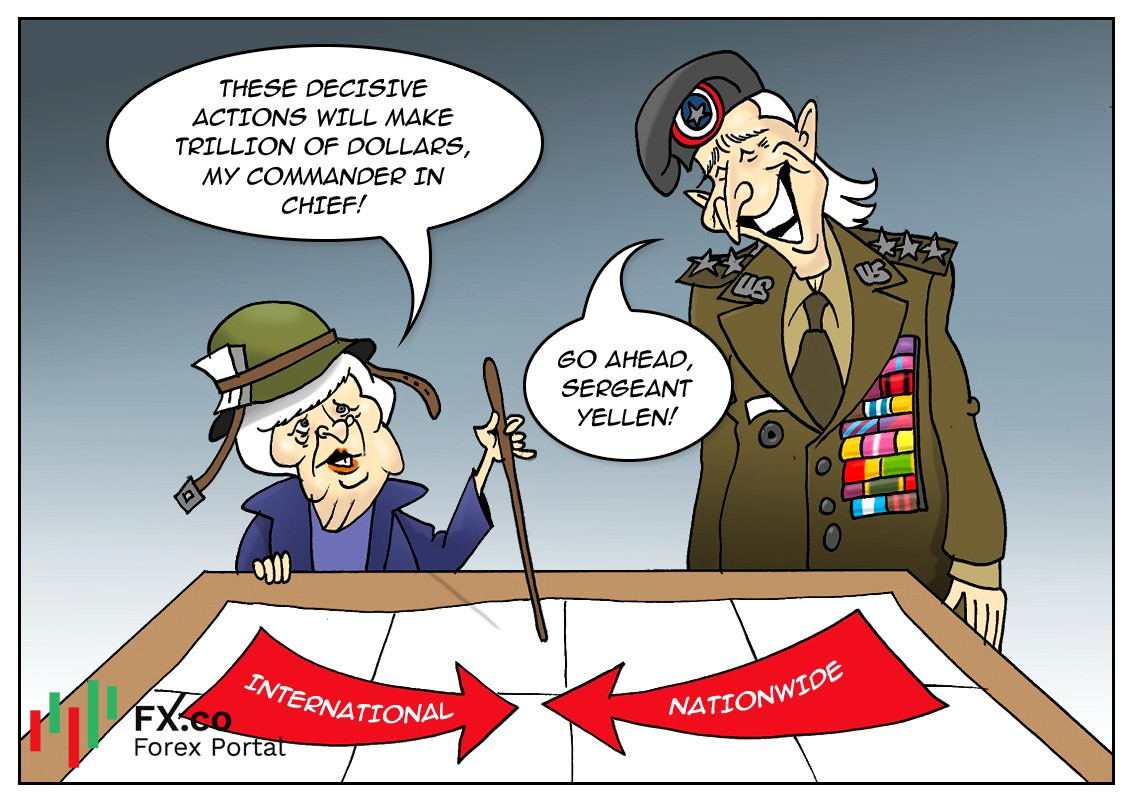

The US government decided to resort to a proven method of increasing the country’s budget, that is, a good old tax hike. Thus, US Treasury Secretary Janet Yellen suggested a substantial overhaul of the US corporate taxation system. According to preliminary estimates, the combination of two different taxation schemes on local and global scales will help raise about $2.7 trillion. The first plan suggests raising the corporate tax rate to 28% from 21%. This plan is aimed at funding Joe Biden’s unprecedented stimulus measures to support the economy. It is expected that the corporate tax hike will add $2 trillion in revenue over the next 10 years. The second biggest change involves international cooperation. In particular, Janet Yellen has recently called for other countries to support the US plan to establish the global minimum tax for corporations. She insisted that the rate should be kept at a set level of about 21%. According to the US Treasury Secretary, this will bring the country $700 billion from income taxes in the next decade. "Our tax revenues are already at their lowest level in generations. If they continue to drop lower, we will have less money to invest in roads, bridges, broadband and R&D," Yellen said. Notably, a proposed increase in revenue taxes will partially offset Donald Trump’s tax reform that lowered corporate taxes to 21% from 35%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: