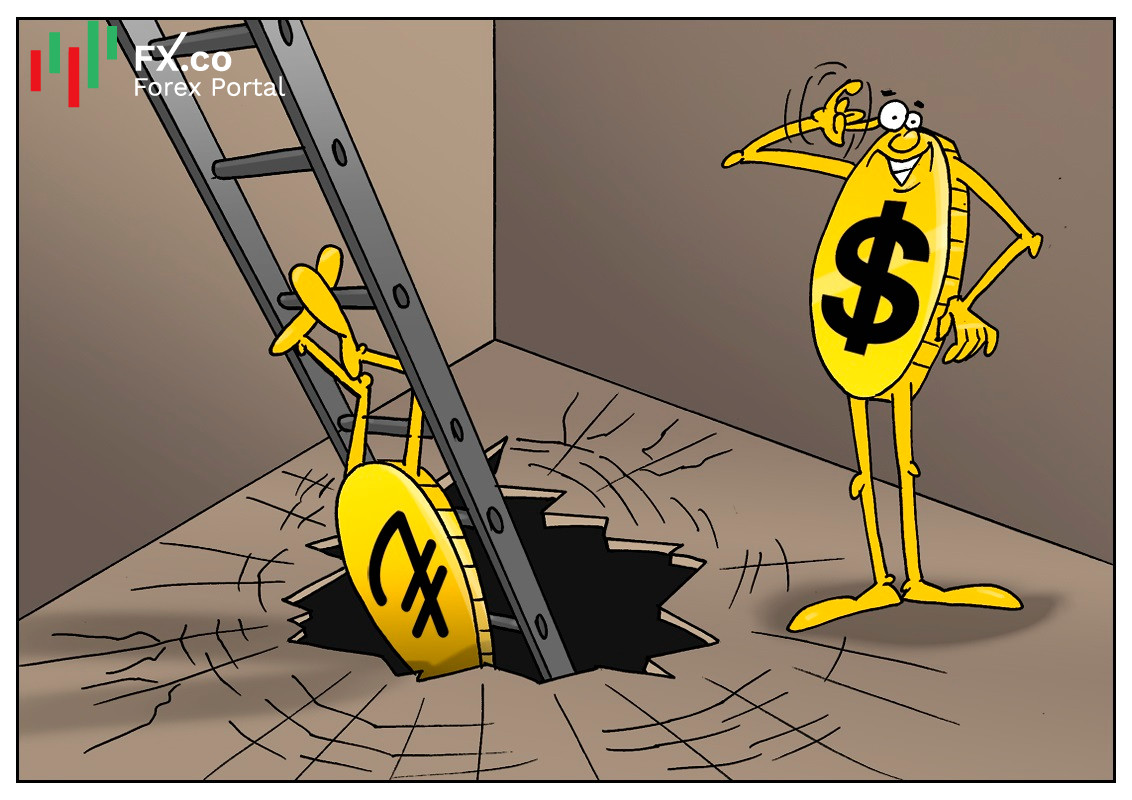

The Turkish lira continues losing value. It seemed that the currency had already reached its all-time low. However, it managed to drop even deeper. Since the beginning of the year, the Turkish lira has lost over 16%. Notably, since the coronavirus outbreak, the currency has depreciated by 44%. The decline is mainly caused by a slump in the tourism revenue and a sharp acceleration in the inflation growth. The country’s population does not trust the financial policy conducted by the local authorities. That is why they have to invest their savings in more stable assets, including other currencies, crypto assets, and gold. What is more, a new wave of devaluation has been provoked by the upcoming repayment of the external debt. In June, Turkish companies had to pay $6.9 billion, the largest sum in the last 10 months. Notably, Turkey’s short-term external debt exceeds $180 billion. The lira is dropping amid the overwhelming distrust of the central bank that is unable to control inflation and take independent decisions. At the same time, the monetary policy is based on unusual economic views of the country’s president Recep Erdoğan. He sincerely believes that high interest rates boost inflation. In the last two years, Recep Erdoğan has fired three governors of the central bank. Recently, he has removed one of four central bank deputy governors. Notably, rising geopolitical tensions is another reason for the decline in the Turkish lira.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: