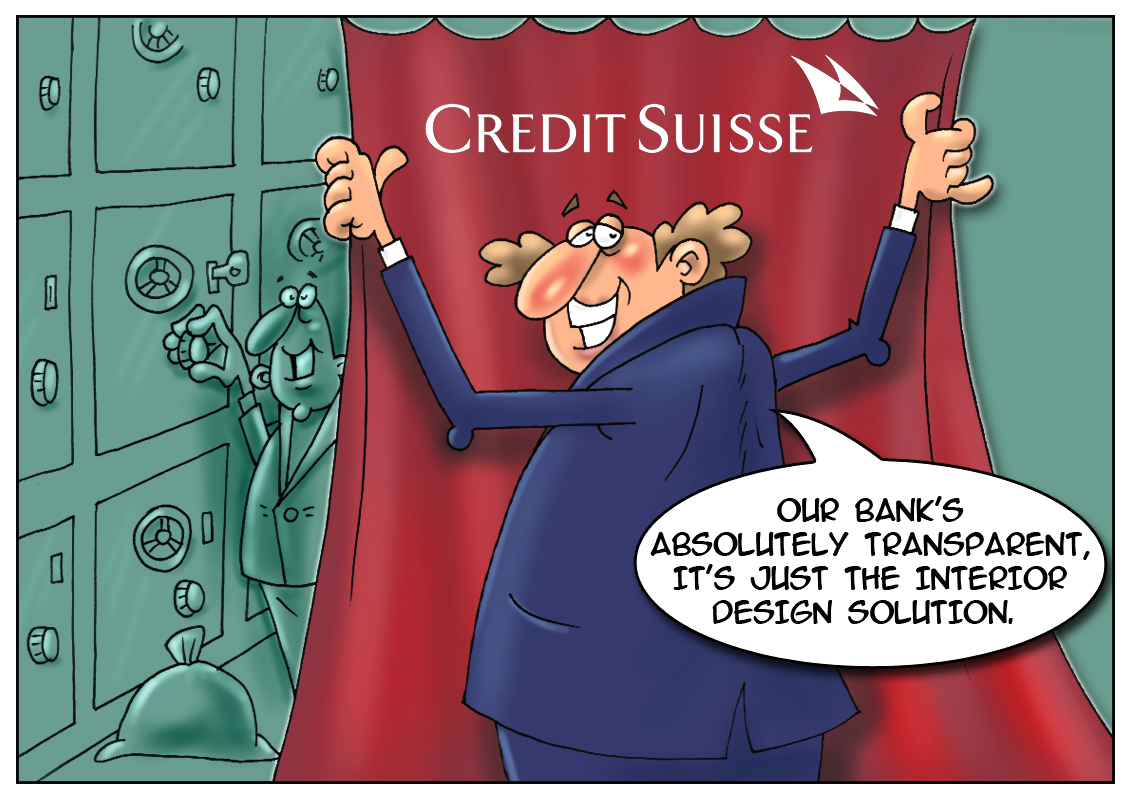

The United States Senate unveiled a report alleging that Credit Suisse “helped its US customers conceal their Swiss accounts" and avoid billions of dollars in American taxes. In simple words, bankers helped the U.S. citizens to hide their earnings from the Internal Revenue Service. The report reads that the bank opened accounts for more than 22,000 U.S. customers with illegal transactions totaling $12 billion. It also said Credit Suisse did not handed over the IRS 95 percent of its account holders’ names. The bank’s criminal schemes seemed to be flawless: Credit Suisse organized special arrival hall in Zurich airport, secret elevators and spaces for negotiations in its office buildings.

Participants of the fraudulent income concealing scheme acted as foreign agents meeting with clients in different places and avoiding any bills or cheques. Sometimes they even handed their customers bank statements hidden in allegedly left magazines or smuggled money into Switzerland. For example, a high-profile customer wanted to smuggle $250,000 inside her tights. There was enough direct and indirect evidence for Credit Suisse to partially admit its guilt. However it said the wrongdoing was not “systematic” and violations were committed “by a small number of bankers”. If so, it seems like this small group built secret elevators and meeting rooms on their own. Today, while the investigation is in progress, Credit Suisse temporarily suspended operations with offshore accounts of the U.S. customers and it is ready to pay $800 billion to settle the Justice Department probe, a figure that lawmakers think is not nearly enough saying "it doesn't fit the malpractice."

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română