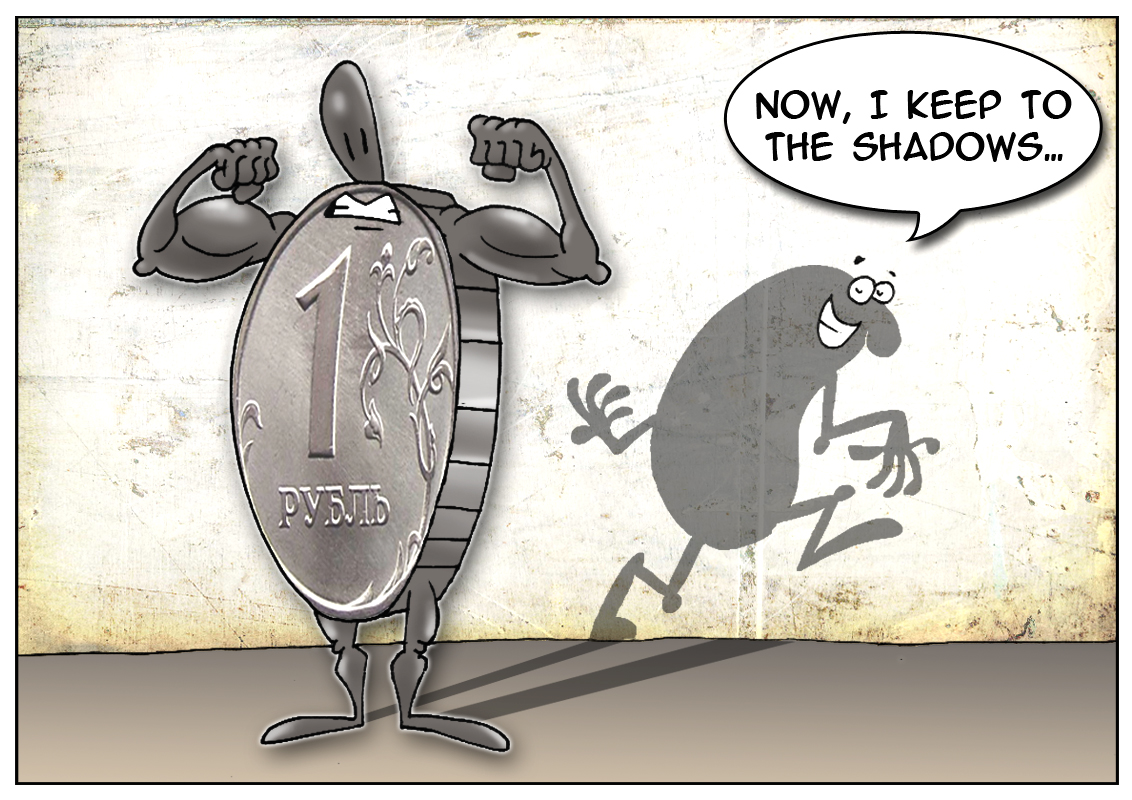

Russia’s economy has been going through hard time on the back of massive public expenses, the impending threat of sanctions from the West, plus large-scale domestic losses. The Federal Financial Monitoring Service of the Russian Federation (Rosfinmonitoring) released the annual report disclosing the appalling figures about outflows of big funds to overseas accounts. According to the regulator, 1.5 trillion rubles are siphoned off outside Russia annually. Yuri Chikhanchin, the regulator’s chief noted that the problem has been festering year by year. He added that unless a solution is found urgently, the problem might get out of control. “Speaking about the extent of cash outflows, banks reveal that 1.5 trillion rubles end up in fraudulent schemes per year. On the plus side, the most of the funds go back. Besides, there are no huge players involved in the scam business nowadays. However, small gangs still exist. It is hardly possible to bring it to an end because huge free cash has been floating in Russia’s economy. This triggers off various fraudulent schemes,” Yuri Chikhanchin reported. The official said that fraudsters who abet money withdrawals abroad can reap a good benefit, about 7% of the total amount. Meanwhile, the Financial Monitoring Service suggested a variety of methods to fight against money laundering, such as a license revocation and a bill about a ceiling for big cash payments within the Russian Federation. Recently, license revocation from several banks in Dagestan and other banks launched a painful strike against shadow cash circulation. In particular, November 20, 2013 the Central Bank of Russia cancelled out Master Bank’s license on the charge of improper accounts. However, Bank of Russia Governor Elvira Nabiullina commented that the bank was involved in servicing the shadow market, illegal cash circulation, and repeated infringement of the money laundering legislation. So, all those with sticky fingers must be ready to answer to a lawsuit.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română