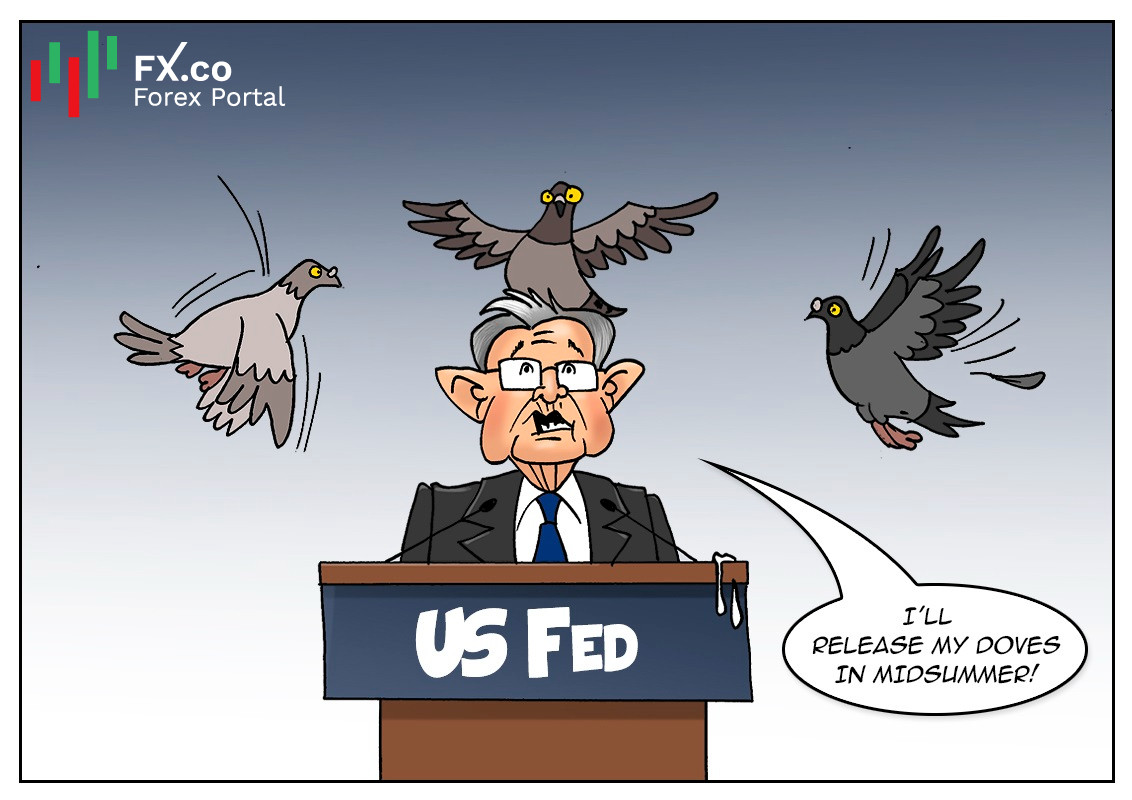

The US central bank’s dovish policymakers are planning to wait for next summer before raising rates from their current near-zero level. They want to get more clarity on the economic outlook by the time the Fed winds down its bond-buying program in mid-2022.

There are two of the most ardent supporters of monetary policy easing in the Federal Open Market Committee, namely Minneapolis Federal Reserve Bank President Neel Kashkari and Chicago Federal Reserve Bank President Charles Evans. Back in September, Neel Kashkari was the only policymaker to call for leaving interest rates unchanged until 2024. Charles Evans also leans dovish. At the same time, both of them have recently stated that they are keeping an "open mind" on monetary policy. Moreover, they are ready to consider various options, but not earlier than midsummer when post-pandemic economic projections will become clearer.

With the latest surge in COVID-19 cases fading in the United States but still disrupting economies worldwide, "we are getting these mixed signals out of the economy," Kashkari said at an event at University of Wisconsin-Eau Claire.

"By the spring we are going to know a lot more about this, and if I'm still kind of making the same excuses, boy they better be really good excuses because it's just not going to sound quite right," Charles Evans noted. Сoronavirus-related supply shortages that are gradually fading have been the main driver of inflation, he added.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: