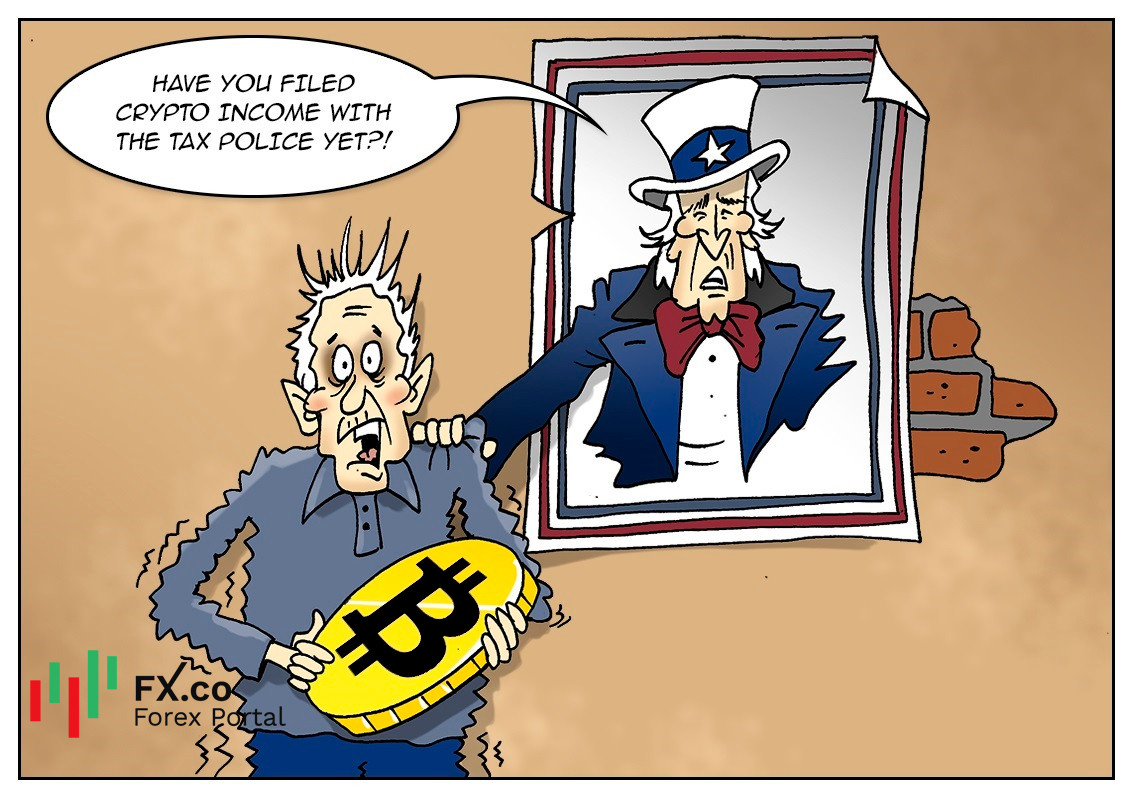

The US authorities keep trying to gain control over the cryptocurrency market. Their new infrastructure bill would oblige crypto brokers and operators to report to the Internal Revenue Service. US President Joe Biden has recently signed a law making cryptocurrency companies, along with other financial organizations, provide information about their users, in particular, notify the IRS of any transactions that exceed $10,000. The cryptocurrency market reacted to the news with a plunge. For instance, BTC lost almost 8%. It seems that the Biden administration is not going to stop there. After all, huge sums of money are at stake. The Joint Committee on Taxation has calculated that the new rule would raise about $28 billion in ten years.

Opponents of the new bill call it extremely expensive and harmful for the crypto industry. They say that the legislation binds certain market participants to provide the information they have no access to. Technically, miners and software developers are unable to report on transactions of over $10,000 to the IRS. Senators Ron Wyden and Cynthia Lummis have filed amendments to the Senate's infrastructure bill, including a proposal to free developers of blockchain technologies and cryptocurrency wallets from tax reporting.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: