In December, the US central bank confirmed that it had to resort to aggressive monetary tightening. Previously, the regulator sent a message to global markets that the ultra-easy monetary policy was coming to an end.

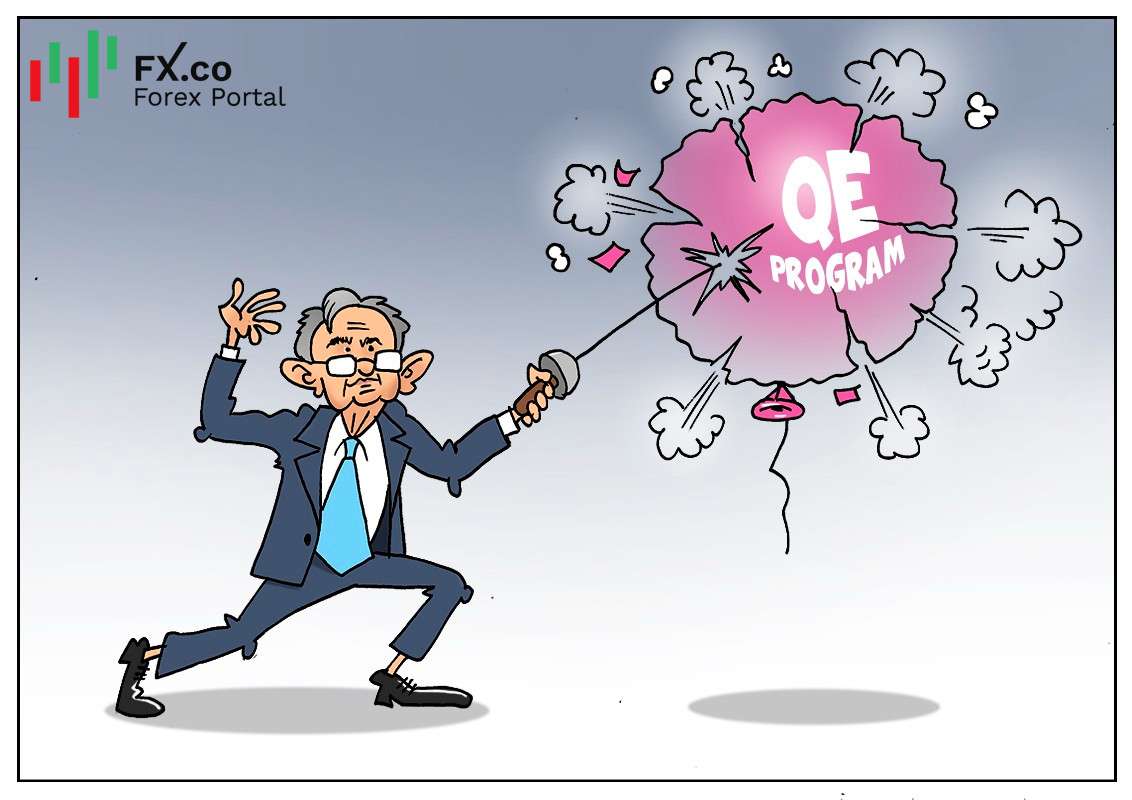

In March 2020, the US Fed embarked on a large-scale emergency QE program. Since then, it has injected $4.4 trillion into the domestic and global economies. With such efforts, the regulator aimed to make up for a crash in global financial markets and the fallout from the worst global depression in the last 70 years. The central bank began tapering in November 2021, scaling back total bond purchases by $15 billion a month, from $120 billion to $105 billion. At the final policy meeting in 2021, the Federal Reserve offered investors a Christmas gift. The policymakers decided to double the pace of withdrawing stimulus to $30 billion per month with a view to terminating the QE program in March 2022.

“With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen,” the Federal Open Market Committee concluded in the statement. “Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation in some economic sectors,” the post-meeting statement reads.

The reasoning behind this decision is that the policymakers are getting less certain that the inflation spike is a short-term snag. Following the policy meeting in September, the high inflation was defined as transitory caused by global headwinds, for example, rising energy prices. This time, the FOMC changed the wording, expecting such factors to be transitory. The last time the Federal Reserve turned off the printing press was back in 2014. Against that background, the US dollar developed the fastest rally since 1999 and oil prices plummeted by almost 60%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: