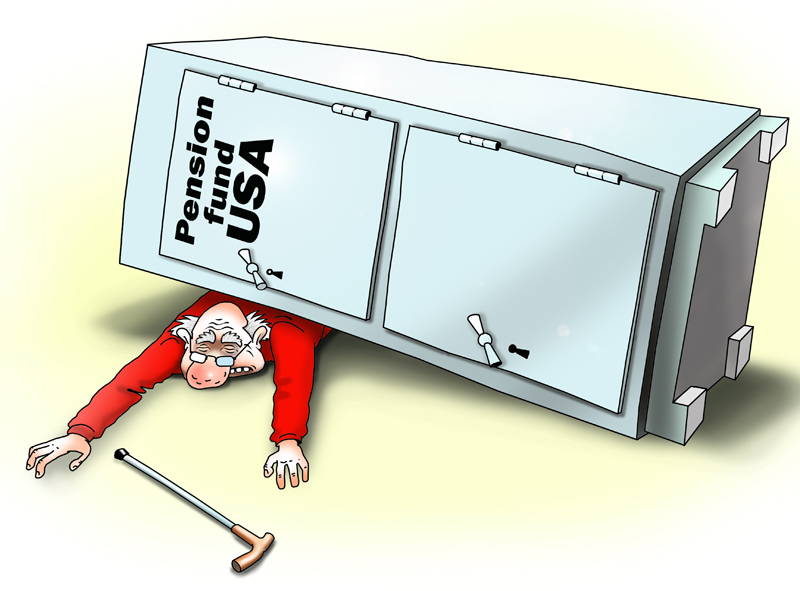

Hedge fund Bridgewater Associates warns the U.S. public pensions are likely to collapse in 30 years, CNBC reports.

After stress testing the nation’s public pension plans, Bridgewater Associates concluded that the funds returns will hardy achieve 4%. The pensions have $3 trillion in assets at that to cover future retirement payments of $10 trillion. According to the organization, to settle all the payments, the yields should be of 9% a year.

The Hedge fund considered many possible scenarios to unfold. In 20% of those, pension funds will run out of money in 20 years; while in 80% of scenarios, public pensions will fail within 50 years. Even at pension observers’ estimate, the pension plans are likely to bring in 7-8% returns. That is way too high since the funds will face a 20% shortfall, Bridgewater notes.

The U.S. pension system resilience has recently become a cause for concern when baby boomers generation (born after 1948) began to retire. In this regard, the ratio between the number of employed population and pensioners that used to be at the peak level started to fall.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română