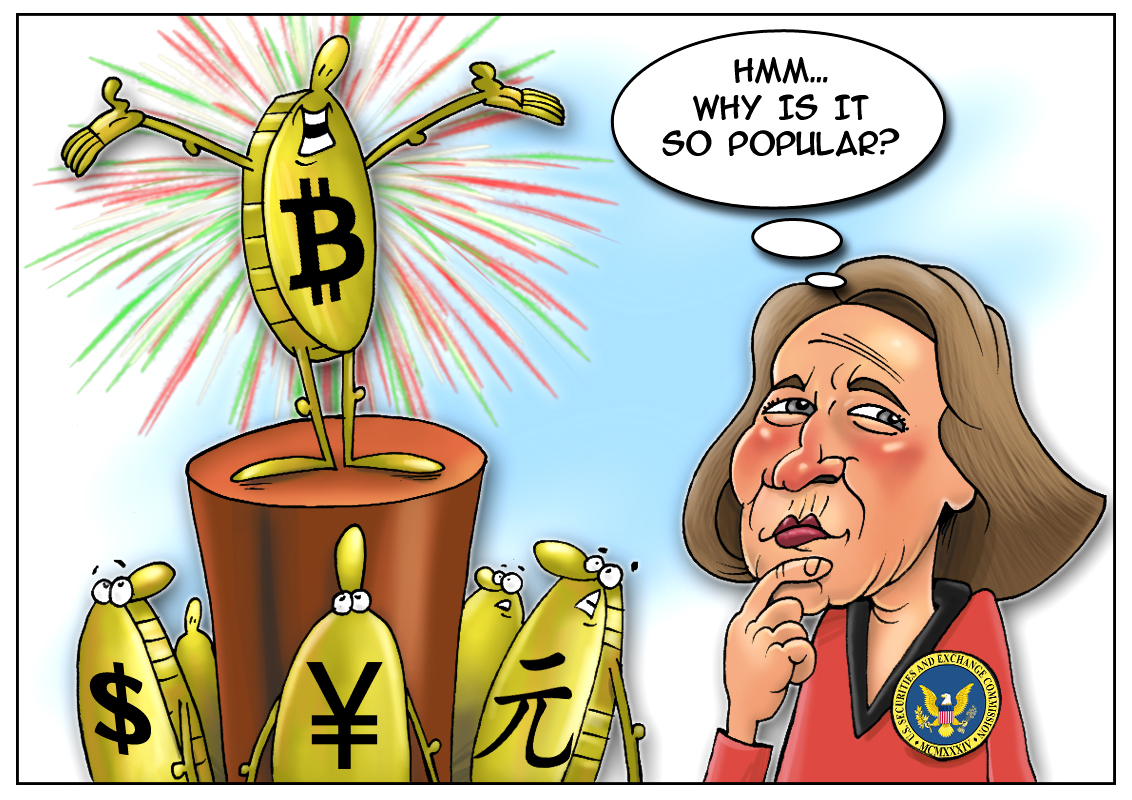

Recently, the US Securities and Exchange Commission has put a strong focus on digital currencies gaining more and more popularity. The official reason of this interest is concerns over high risks carried by these assets. The commission issued an alert cautioning investors about “potential risks of investments involving Bitcoin and other forms of virtual currency”. This investor alert says that investing in digit currencies increases threats of frauds and illegal financial operations to a large degree. In case of a theft of funds, there is no guarantee that you will get them back. “A new product, technology, or innovation – such as Bitcoin – has the potential to give rise both to frauds and high-risk investment opportunities. Potential investors can be easily enticed with the promise of high returns in a new investment space and also may be less skeptical when assessing something novel, new and cutting-edge”, said the SEC in a statement. In addition, the commission stressed the status of the cryptocurrency: bitcoin is not a legal tender. However, despite the grave risks, the virtual currency is gaining popularity in the US at a furious pace. The other day Bloomberg announced a regular bitcoin price listing. The reason for such a step is very simple – it has been the most frequently asked operation lately. The financial media corporation admitted the virtual currency has become a considerable asset since it appeared on the market. Now, it is capable to influence economies and financial markets. Bloomberg will use current prices from Coinbase and Kraken bitcoin exchanges. Also, the media agency plans to use information from over 100,000 internet sources, including blogs and social media posts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română