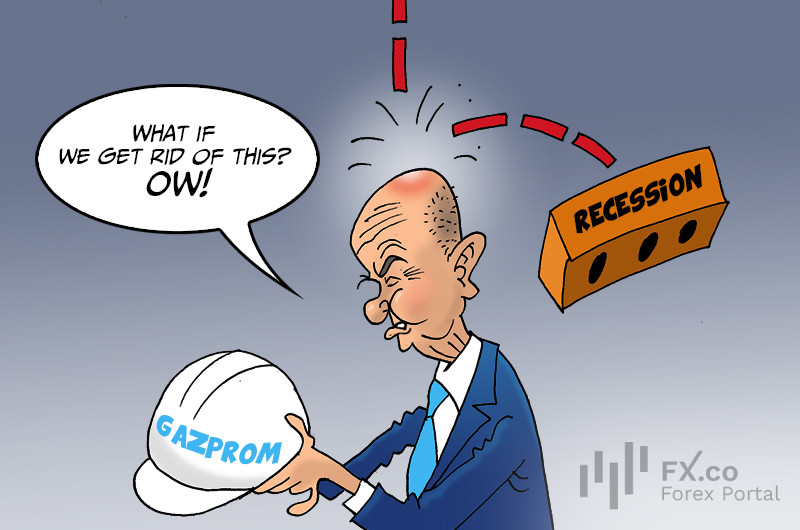

Nowadays, every news piece is about recession and various risks, especially in Europe. Most analysts suppose that Europe will hardly avoid an economic downturn.

According to the recent Bloomberg estimates based on a poll of economists, there is an 80% likelihood that Europe will slip into recession in the first two quarters of 2023. Only a month ago, the risk of such a scenario totaled just 60%. The energy crisis spurred by lower supplies of Russian gas is still the key reason for the upcoming decline in economic activity. European enterprises have to reduce production, which immediately affects the economy. Thus, Germany’s economy, which highly depends on Russian hydrocarbons, may contract as early as the fourth quarter of this year.

By the end of 2022, inflation is likely to surge to a high of 9.6%. To cap the rise, the European Central Bank will have to raise the key interest rate by 75 basis points to the peak of 2% by February. In the best-case scenario, the central bank will be able to return inflation to the target level of 2% only in 2024.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: