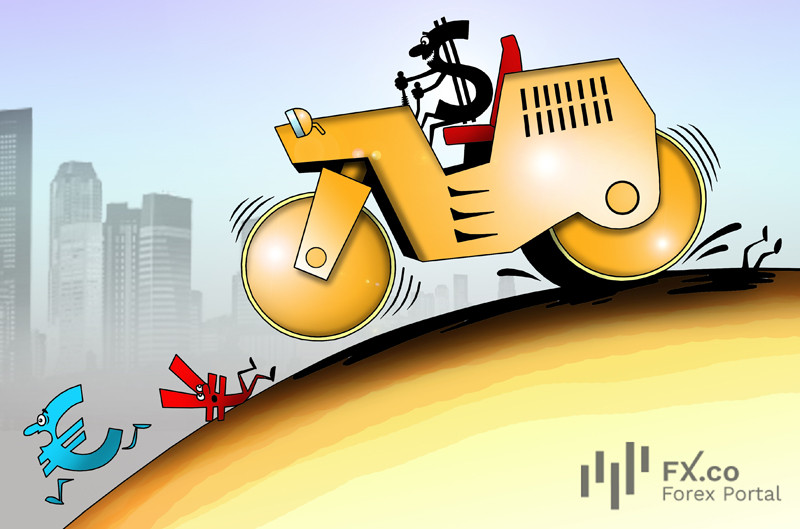

Economists raise concerns that the US dollar's strengthening causes a threat to the global economy. USD is holding higher ground while its satellite currencies are losing grip. The world is likely to witness a new economic order that shapes its beneficiaries and losers. Aggressive Fed monetary policy triggers a scenario, revealing the reasons for the greenback's rise against the US trading partner’s national currencies. Last week, September 19-25, the US central bank increased its key rate by 0.75% to 3%-3.25%. The regulator confirmed that the rates may rise to 4% by the end of 2022. Nevertheless, the dollar becomes more alluring to investors. Among the reasons, the US energy sector proved to be more resilient than the EU’s one. At the same time, the country’s regulator is succeeding in its fight against inflation at home. Economists warn about the rising risks of a debt crisis. Developing countries use USD to cover their government debt and this may send their economies into a freefall. Developed countries with a debt-to-GDP ratio exceeding 100% may also experience debt policy turmoils, experts warned. The higher the US dollar's exchange rate, the heavier burden falls on other countries, especially the poorest. Against this background, experts fear a new large-scale currency crisis similar to the one that occurred in 1998 in Asia. Higher interest rates add to the risks to the debt sustainability of most countries that use USD to pay for their government debts. At the same time, higher rates push up state budget spending and reduce economic stimulus capabilities. Most countries have become trapped. Against this background, the European Union is suffering from record inflation, China is trying to cope with the real estate market shock waves, and Japan is struggling with rising commodity and raw material prices. The US economy is also under pressure amid the falling income of domestic corporations located abroad and declining exports. An alternative to the dollar could be gold, which has proven itself to be a safe-haven asset. The world will start to build a new economic development model, experts concluded.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română