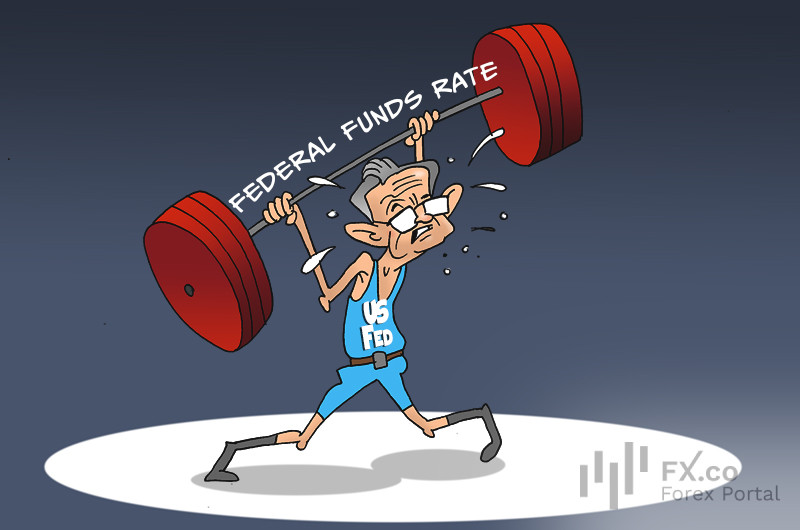

The US Federal Reserve has raised its benchmark interest rate for the third consecutive time and is expected to do the same by the end of the year. This measure is supposed to help reduce global prices of oil, gas, and metals as well as other goods. The thing is that commodities are denominated in US dollars and most international settlements in the commodities markets are carried out in USD. The central bank’s decision came fully in line with the policy of the White House. This time, there was no disagreement between the Fed and the US government regarding monetary tightening. The regulator raised the rate by 75 basis points to 3-3.25%. Fed Chair Jerome Powell confirmed that the Fed would continue to hike the rate up to a certain level and then would keep it there. The main goal of the US central bank is to bring inflation down to the target level of 2%. “The Federal Open Market Committee decided to raise the target range for the federal funds rate to 3–3.75% and anticipates that ongoing increases in the target range will be appropriate,” the official statement reads. The report shows that the majority of FOMC members see the rate in the range of 4.25-4.5% by the year-end.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: