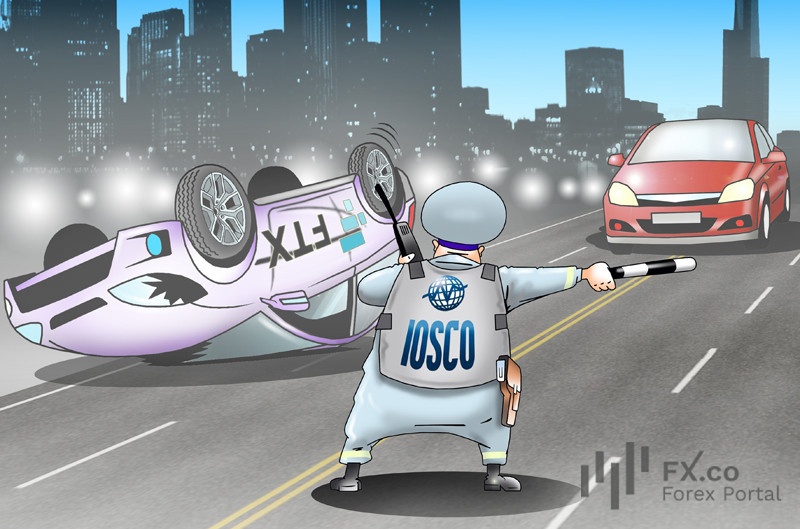

Following the crash of one of the largest crypto exchanges, FTX, global regulators highlighted the need for tighter regulation of the crypto segment. Targeting crypto exchanges will be the main focus for regulatory authorities in 2023, according to Jean-Paul Servais, the new chair of global securities watchdog IOSCO. For years, the regulation of digital assets has been inconsistent: it has been mainly focused on preventing and eliminating violations in a timely manner. Yet, a spectacular collapse of the FTX exchange made it clear that this sector needs more scrutiny. For your reference, the FTX bankruptcy left almost 1 million creditors with losses totalling billions of dollars. The security of cryptocurrency transactions will be discussed at an international level, Jean-Paul Servais explained. IOSCO, which coordinates rules for G20 and other countries, has already set out principles for regulating stablecoins. Its next step will be to tighten control of the platforms where tokens are traded. Many analysts share the view that trading crypto requires stricter regulation. IOSCO is expected to target this issue. "For investor protection reasons, there is a need to provide additional clarity to these crypto markets through targeted guidance in applying IOSCO’s principles to crypto assets," Servais said. IOSCO, or International Organization of Securities Commissions, is an umbrella body for market watchdogs like the Securities and Exchange Commission in the United States, Bafin in Germany, Japan's Financial Services Agency, and the UK Financial Conduct Authority. The above-mentioned organizations are required to follow recommendations provided by IOSCO.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: