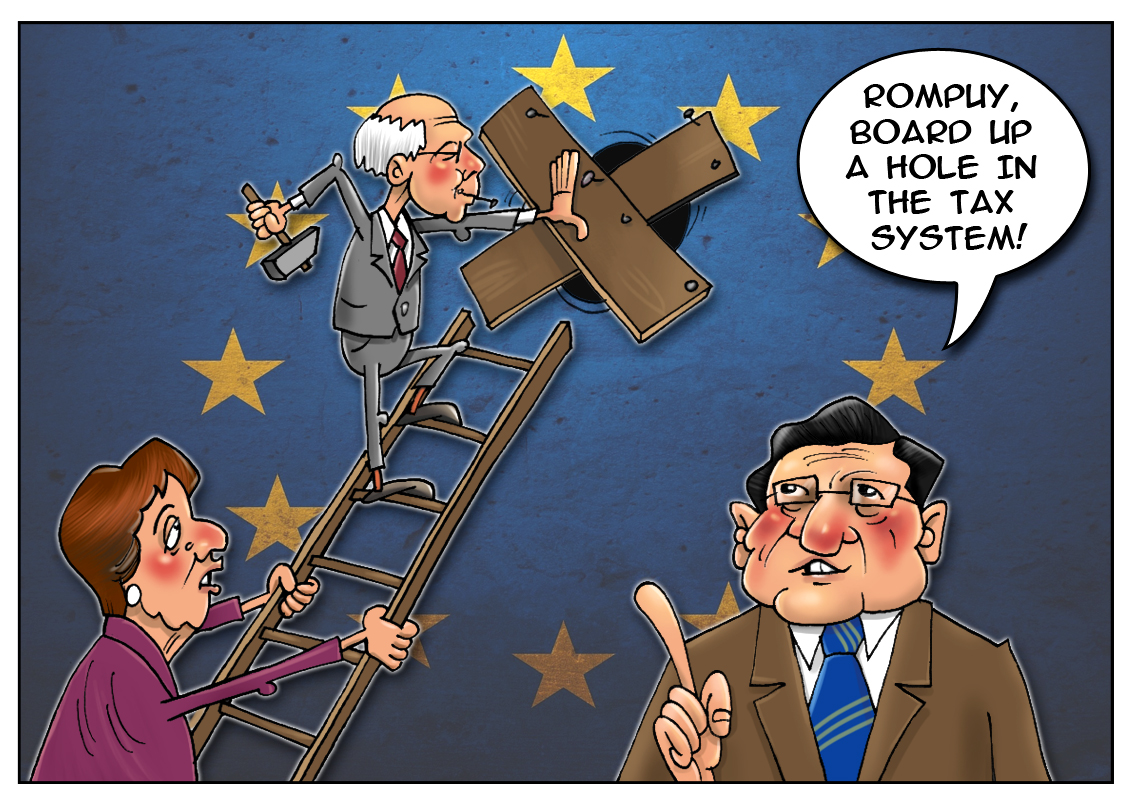

The EU authorities are planning to eliminate the tax loophole, which has enabled transnational companies to take advantage of the national tax regulations and cut the tax expenses. The revenue laws regulating branches and affiliates of large international companies allow some ways to evade certain tax payments. This decision was preceded by long months of talks. Now the EU states may well see more tax payments coming in. The corporate tax evasion has become an acute problem for industrially developed countries. Merchants were doing their best to escape from taxes during tough post-crisis austerity.

"The aim is to close a loophole that currently allows corporate groups to exploit mismatches between national tax rules so as to avoid paying taxes on some types of profits distributed within the group," finance ministers said in a statement. The changes will impact parent companies and subsidiaries located at different addresses; hybrid financing that is frequently used as an instrument of tax planning.

"Using an (EU) directive that was based on common sense - avoid double-taxation - a few cunning devils had managed to pay no tax at all," French Finance Minister Michel Sapin said, welcoming the move. "That will mean a bit more money in state coffers, which as you know we're quite keen on."

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română