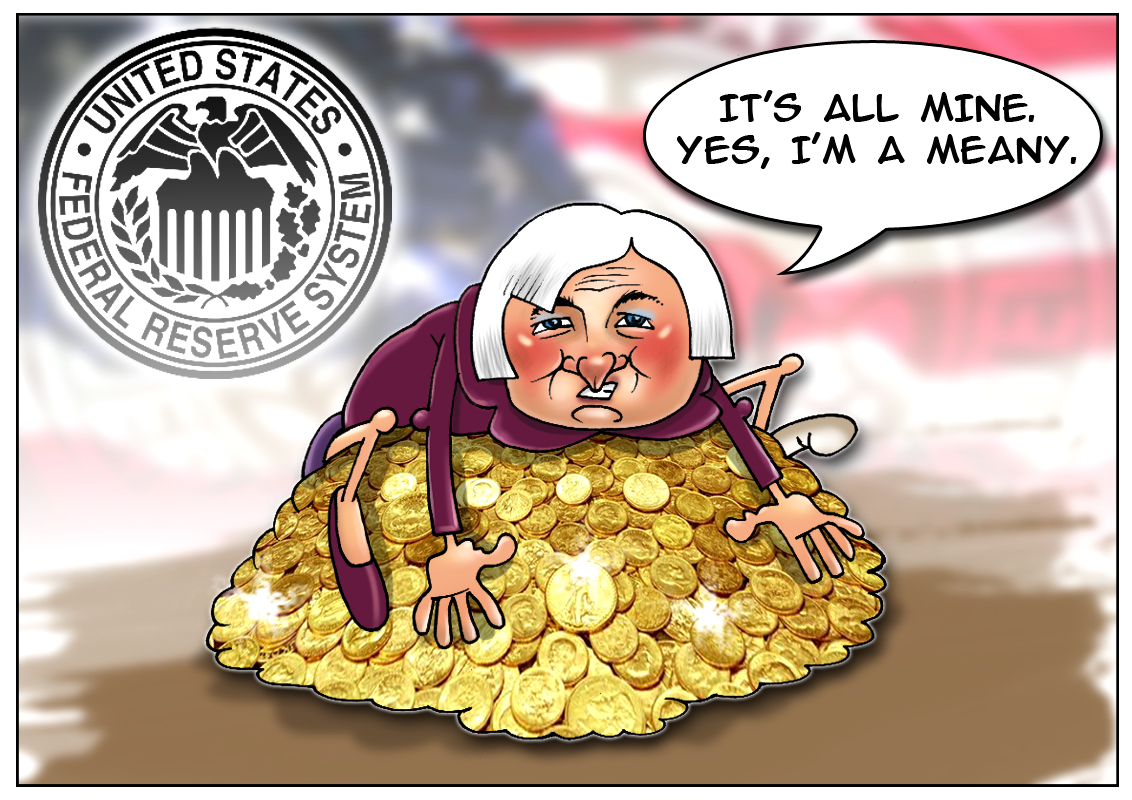

The officials at the U.S. Federal Reserve have made a broad hint that there are no plans afoot to sell their assets. According to the Fed’s official statement, the regulator aims to maintain its record balance sheet for years. The main reason for such a decision is the risk to undermine or even halt the incipient signs of economic recovery. It is noteworthy that the Fed’s holdings have risen to over $4.3 trillion. As for the withdrawal of quantitative easing, the Fed is expected to maintain its tapering pace. The central bank’s head reported further cuts of bond buying program, which was the main weapon against the worst recession since the Great Depression. At the same time, the process of purchases stole the spotlight. Meanwhile, few people are interested in what to do with the large Federal Reserve’s balance sheet. Currently, market participants fear that assets’ sell-off would trigger long-term interest rates hike, thus making it more expensive for consumers to buy goods on credit and companies to invest, according to James Bullard, president of the Federal Reserve Bank of St. Louis. That “is a widespread view in parts of the Fed, I think, and in financial markets,” Bullard said in an interview last week. However, he disagrees with that perspective. “It is pretty clear they are anticipating operating in a situation with a lot of reserves and a high balance sheet for a long time,” said former Fed governor Laurence Meyer, a co-founder of Macroeconomic Advisers LLC, a St. Louis-based forecasting firm. Thus, the Fed’s portfolio of assets remains untouched.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română