Latest data released by Eurostat - 13 November 2020

GDP -4.4% vs -4.3% y/y prelim

Little change to the initial releases as this just reaffirms the strong bounce back in Q3, though the market focus is on the outlook towards the year-end and the heightened virus situation across the region currently.

For some added context, Eurozone GDP is still 4.4% below pre-pandemic levels after the boost seen in Q3 as per the above.

Further Development

Analyzing the current trading chart of EUR , I found that there was the strong rejection of the pivot resistance at 1,1830, which is strong sign of the selling power.

Watch for selling opportunities with the targets at 1,1740 and 1,1630

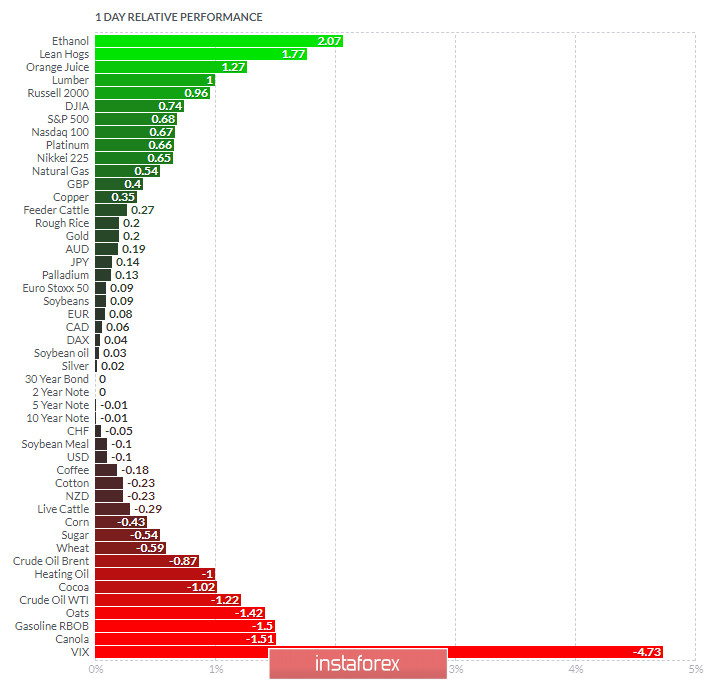

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and VIX and on the bottom Lean Hogs and Canola.

Key Levels:

Resistance: 1,1830

Support levels: 1,1740 and 1,1630

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română