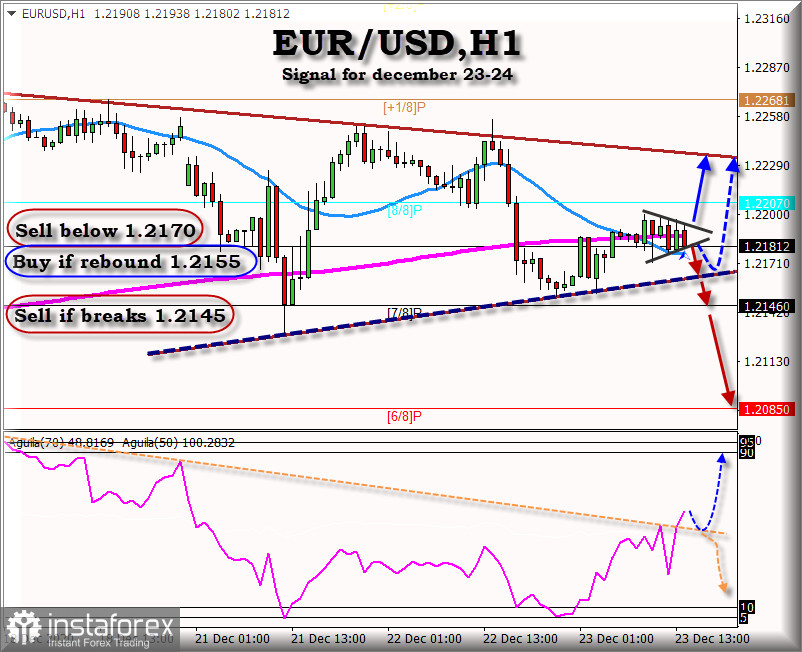

The EUR / USD at the opening of the American session is trading within a small triangle of 1 hour, below the EMA 200, and under downward pressure, a definitive break of 1.2150, we could expect a fall to 6/8 of murray.

In the United States, while an agreement has not yet been reached on the $ 900 billion covid relief stimulus bill. USDX will continue to gain strength and this could push the euro-dollar to 1.2085 levels.

On the contrary, we could see a rally to the 1.2230 and 1.2268 (+1/8 murray) area of very strong resistance.

Eagle indicator is showing bullish strength this morning, breaking the bearish signal line, and going to the area 90, it is likely that this increased volume of negotiations, pending fiscal stimulus in the United States.

Market sentiment for today December 23 is showing that there are 62% of traders that are selling this pair, we have noticed a decrease of 5% since the beginning of the week, this could be a sign of a probable downward movement of the EUR / USD for the next few days.

Our recommendation is to sell, as long as the pair is below the 200 EMA in 1 hour charts, and below the 21 SMA, if you see that the EUR / USD pair is trading below these levels, we recommend selling with targets at 1.2085.

Trading tip for EUR/USD for December 23 – 24

Sell below (EMA 200 and SMA 21) around 1.2180, with take profit at 1.2146 (7/8 of murray) and 1.2085, stop loss above 1.2210.

Buy if the pair rebound around 1.2155 (trend line), with take profit at 1.2207 (8/8 of murray) and 1.2235, stop loss below 1.2115.

Sell if breaks 1.2140, (7/8) with take profit at 1.2085, stop los above 1.2175.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română