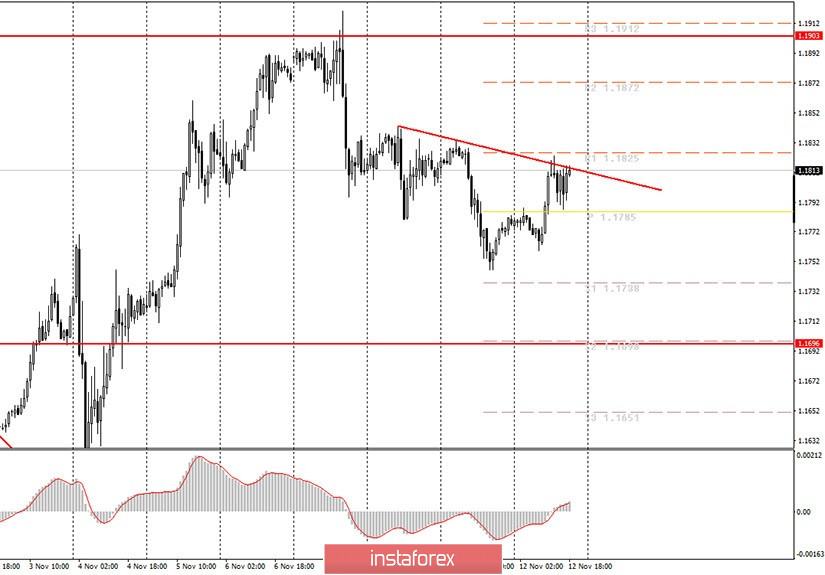

Hourly chart of the EUR/USD pair

Instead of bringing back the downward movement, the EUR/USD pair began a new round of corrective movement on Thursday, November 12. However, the MACD indicator did not turn down during the day, so a sell signal was not generated. And so, according to our recommendations, novice traders should not have opened short positions today. At the same time, a descending trend line appeared today. On the one hand, this is good. It makes it possible to track another possible buy or sell signal. By retreating or going beyond the trend line. On the other hand, the price has not rebounded and this line was not overcome, the price is simply trading near this line. Therefore, the situation is now of the following kind. The downward trend is still preserved and the price rebounding from the trend line will enable us to open short positions while aiming for the lower line of the horizontal channel at $1.17-1.19. Overcoming the trend line will signal a change in the short-term trend to an upward one, and then we can expect an upward movement to the upper line of the horizontal channel at 1.1903. In general, the euro/dollar pair continues to trade in a horizontal channel, so there is still no long-term trend.

Novice traders should have turned their attention to the US inflation report. The consumer price index began to slow down in America once again, which is not a positive factor for the US economy and the dollar. Inflation decelerated in annual terms from 1.4% to 1.2%. Core inflation slowed down from 1.7% to 1.6%. In addition, inflation in Germany remained in the negative territory. But German inflation has a much smaller impact on the euro/dollar pair. Thus, the fact that the US dollar depreciates most of the day is quite reasonable. Christine Lagarde and Jerome Powell (president of the European Central Bank and the US Federal Reserve, respectively) will also deliver speeches and this can also affect the pair's movement on the remainder of Thursday and Friday night.

The EU is slated to publish its third quarter Gross Domestic Product on Friday. According to forecasts, the indicator will be +12.7% q/q, however, market participants are already prepared for this figure, since they were just like that a month ago (first estimate). Therefore, only a serious deviation from the forecast can provoke a market reaction. No other important news is scheduled for the final trading day of the week. But we continue to recommend you to follow political news from the United States, since Donald Trump might mention something interesting.

Possible scenarios for November 13:

1) Buy positions on the EUR/USD pair remain irrelevant at this time. However, if the price settles above the downward trend line, then novice traders are advised to open long positions with targets at 1.1872 and 1.1903. It may be better to wait until morning.

2) Trading for a fall is still more relevant at this time, as the downward trend continues. Thus, novice traders are advised to wait now for a rebound from the trend line and a downward reversal of the MACD indicator. Then we will recommend selling the pair with targets at 1.1738 and 1.1696. Similar to long deals, it may be best to wait until morning.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română