To open long positions on GBPUSD, you need:

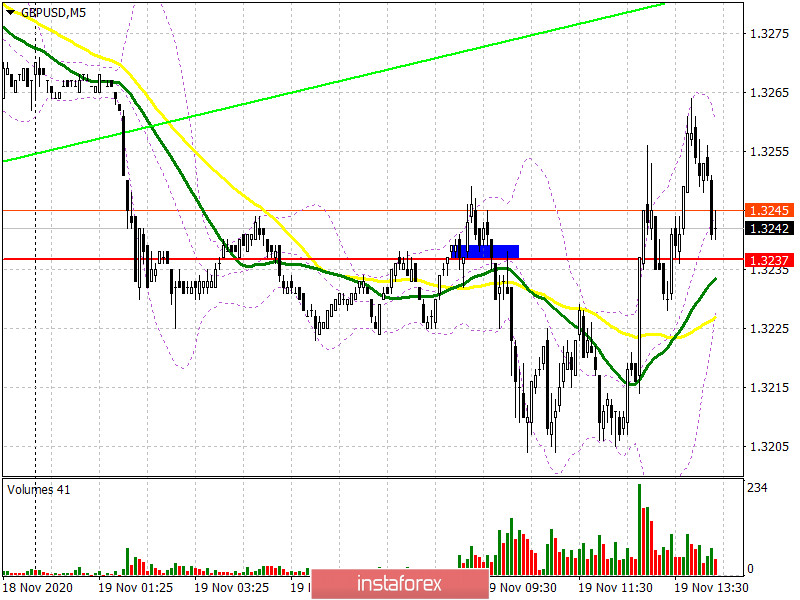

In my morning forecast, I paid attention to the level of 1.3237 and recommended to act from it based on the situation. Let's look at the 5-minute chart and see what happened. Initially, the bulls tried to take the area of 1.3237 and even broke above this range by testing it from top to bottom, which led to the formation of a buy signal, which immediately led to a loss, as the bears quickly regained control of this level. Then, after a confident consolidation below 1.3237, a reverse test of the area of 1.3237 took place from the bottom up, which led to the formation of a sell signal for the pound. The movement from this level was more than 30 points, however, it was not possible to achieve the formation of a larger downward trend.

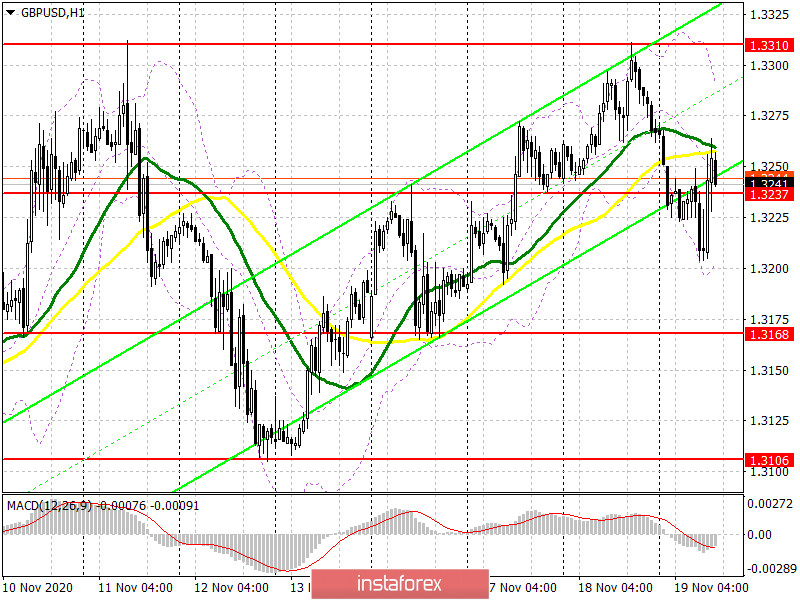

If you look at the hourly chart, you will see that buyers managed to return the pound to the level of 1.3237 again, keeping the initiative on their side. Only if the bulls hold 1.3237, or achieve the formation of a false breakout, I recommend opening long positions in the continuation of the upward trend. This may happen immediately after the release of data on the US labor market, as the number of initial applications for unemployment benefits may jump sharply amid the growth of the coronavirus epidemic in the United States. If the report turns out to be worse than economists' forecasts, the bulls will continue to buy the pound. In this case, the nearest target for buyers will be this month's maximum of 1.3310. Only a break and consolidation above this range forms a new wave of growth of the pound with an exit to the area of 1.3378 and 1.3467, where I recommend fixing the profits. In the scenario of good data on the US economy and the return of GBP/USD to the level of 1.3237, it is best to postpone long positions until the minimum of 1.3168 is updated or buy the pair immediately for a rebound from the larger area of 1.3106, which is a kind of lower border of the wide side channel 1.3106-1.3310 in which the pound is all this month.

To open short positions on GBPUSD, you need:

The bears are still fighting to regain control of the level of 1.3237, which they managed to miss in the first half of the day. Particular attention is focused on the Brexit news, as it will set the tone of the market at the end of this week. The initial task is to return GBP/USD to the level of 1.3237 and test it from the bottom up, which forms a fairly good entry point into short positions, which will be able to push the pound to a minimum of 1.3168, where I recommend fixing the profits. Only a breakout of 1.3168 with consolidation under this range will give sellers of the pound more confidence, which will open a direct road to the lows of 1.3106 and 1.3034. In the scenario of a lack of activity among sellers and poor data on the US economy, it is best to postpone short positions until the maximum of 1.3310 is updated, provided that a false breakout is formed there. I recommend selling GBP/USD immediately for a rebound from the maximum of 1.3378, based on a correction of 20-30 points within the day.

In COT reports (Commitment of Traders) for November 10, there was a minimal increase in long positions and a sharp influx of short positions. Non-commercial long positions grew from 27,701 to 27,872. At the same time, short non-commercial positions increased from the level of 38,928 up to the level of 45,567. As a result, the negative non-commercial net position was -17,695, compared to -11,227 a week earlier, which indicates that sellers of the British pound remain in control and have an advantage in the current situation.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily averages, which indicates the sideways nature of the market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pound rises, the upper limit of the indicator around 1.3300 will act as a resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română